OECD Tax Database

The OECD Tax Database

Comparative information on a range of tax rates and statistics in the OECD member countries, and corporate tax statistics and effective tax rates for inclusive framework countries, covering personal income tax rates and social security contributions applying to labour income; corporate tax rates and statistics, effective tax rates; tax rates on consumption; and environmental taxes.

Key graphics and messages on statutory tax rates and key labour tax indicators can be found in the Tax Database brochure:

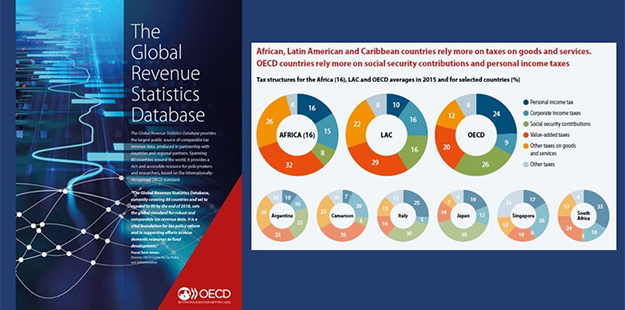

Global Revenue Statistics

|

|

The Global Revenue Statistics Database provides detailed comparable tax revenue data for African, Asian and Pacific, Latin American and the Caribbean and OECD countries from 1990 onwards. The database provides the largest source of comparable tax revenue data, which are produced in partnership with participating countries and regional partners. The following documents are also available:

|

Global Revenue Statistics latest visualisation

Revenue Statistics OECD country summaries

Australia | Austria | Belgium | Canada | Chile | Colombia | Costa Rica | Czechia | Denmark | Estonia | Finland | France | Germany | Greece | Hungary | Iceland | Ireland | Israel | Italy | Japan | Korea | Latvia | Lithuania | Luxembourg | Mexico | Netherlands | New Zealand | Norway | Poland | Portugal | Slovak Republic | Slovenia | Spain | Sweden | Switzerland | Turkey | United Kingdom | United States

Source: Revenue Statistics

Revenue Statistics in Latin America and the Caribbean country summaries

Argentina | Bahamas | Barbados | Belize | Bolivia | Brazil | Chile | Colombia | Costa Rica | Dominican Republic | Ecuador | El Salvador | Guatemala | Guyana | Honduras | Jamaica | Mexico | Nicaragua | Panama | Paraguay | Peru | Saint Lucia | Trinidad and Tobago | Uruguay

Source: Revenue Statistics in Latin America and the Caribbean

En español

Argentina | Bahamas | Belice | Bolivia | Brasil | Barbados | Chile | Colombia | Costa Rica | República Dominicana | Ecuador | Guatemala | Guyana | Honduras | Jamaica | Santa Lucía | México | Nicaragua | Panamá | Perú | Paraguay | El Salvador | Trinidad y Tobago | Uruguay

Fuente : Estadísticas tributarias en América Latina y el Caribe

Revenue Statistics Africa country summaries

Botswana | Burkina Faso | Cabo Verde | Cameroon | Chad | The Republic of the Congo | Côte d'Ivoire | The Democratic Republic of the Congo | Egypt | Equatorial Guinea | Eswatini | Gabon | Ghana | Guinea | Kenya | Lesotho | Madagascar | Malawi | Mali | Mauritania | Mauritius | Morocco | Namibia | Niger | Nigeria | Rwanda | Senegal | Seychelles | Sierra Leone | South Africa | Togo | Tunisia | Uganda

En français

Afrique du Sud | Botswana | Burkina Faso | Cabo Verde | Cameroun | Congo | Côte d'Ivoire | République démocratique du Congo | Égypte | Eswatini | Gabon | Ghana | Guinée | Guinée équatoriale | Kenya | Lesotho | Madagascar | Malawi | Mali | Maurice | Mauritanie | Maroc | Namibie | Niger | Nigeria | Ouganda | Rwanda | Sénégal | Seychelles | Sierra Leone | Tchad | Togo | Tunisie

Source: Revenue Statistics in Africa

Revenue Statistics in Asia and Pacific country summaries

Armenia | Australia | Azerbaijan | Bangladesh | Bhutan | Cambodia | China | Cook Islands | Fiji | Georgia | Hong Kong (China) | Indonesia | Japan | Kazakhstan | Kiribati | Korea | Kyrgyzstan | Lao (PDR) | Maldives | Malaysia | Marshall Islands | Mongolia | Nauru | New Zealand | Pakistan | Papua New Guinea | Philippines | Samoa | Singapore | Solomon Islands | Sri Lanka | Thailand | Timor-Leste | Tokelau | Vanuatu | Viet Nam

Source: Revenue Statistics in Asia and the Pacific

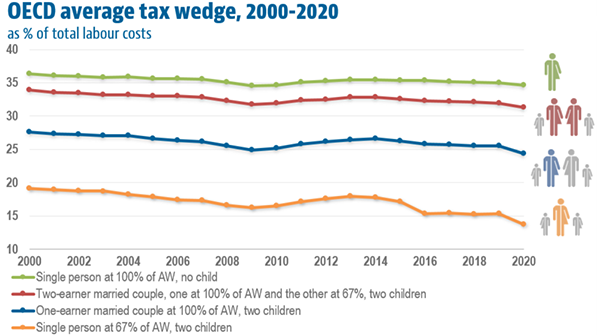

Taxes on labour income

Taxes on labour (year 2000 onward)

Statutory personal income tax rates and thresholds

- Central government personal income tax rates and thresholds

- Sub-central personal income tax rates - non-progressive systems

- Sub-central personal income tax rates - progressive systems

- Top statutory personal income tax rate and top marginal tax rates for employees

Other measures of tax burden on wage income

- Marginal personal income tax and social security contribution rates on gross labour income

- Average personal income tax and social security contribution rates on gross labour income

- All-in average personal income tax rates at average wage by family type

Social security contributions

- Employee social security contribution rates and related provisions

- Employer social security contributions

- Social security contributions paid by the self-employed

Published: April 2023

Source: Taxing Wages

Explanatory notes

Each country provides detailed information on the data presented within the personal income tax rates and social security contributions tables.

Non-tax compulsory payments (NTCP)

Non-tax compulsory payments (NTCPs) operate in a similar way to taxes in that they serve either to increase the employer’s labour costs or to reduce the employee’s net take-home pay.

- Average net personal compulsory payment wedges (Table 1)

- Average net personal compulsory payment rates (Table 2)

- Marginal net personal compulsory payment wedges (Table 3)

- Marginal net personal compulsory payment rates (Table 4)

- Changes in total labour costs and net take-home pay (Tables 5 and 6)

- Average tax wedges and compulsory payment wedges (Figure 1)

- Marginal tax wedges and compulsory payment wedges (Figure 2)

Published: April 2024

Source: Non-tax compulsory payments

Table notes

In many OECD countries employers have to make compulsory payments on behalf of their employees which do not qualify as taxes and social security contributions. The OECD has therefore calculated a set of compulsory payment indicators which are designed to show the combined impact of taxes and NTCPs net of benefits.

Historical statutory personal income tax rates and thresholds (1981-99)

- Central government personal income tax rates and thresholds (1981-1999)

- Sub-central personal income tax rates - non-progressive systems (1981-1999)

- Sub-central personal income tax rates - progressive system (1981-1999)

Published: 2008

Source: Taxing wages (discontinued historical models)

Related publication: Taxation and Economic Growth

Table notes

Data for the years from 1981 to 1999 were collected as part of a special project. These data have not been verified since, but are made available to people who would wish to use them, and are aware of their possible limitations.

Taxing Wages country summaries

Australia | Austria | Belgium | Canada | Chile | Colombia | Costa Rica | Czechia | Denmark | Estonia | Finland | France | Germany | Greece | Hungary | Iceland | Ireland | Israel | Italy | Japan | Korea | Latvia | Lithuania | Luxembourg | Mexico | Netherlands | New Zealand | Norway | Poland | Portugal | Slovak Republic | Slovenia | Spain | Sweden | Switzerland | Türkiye | United Kingdom | United States

Source: Taxing Wages

Taxing Wages latest visualisation

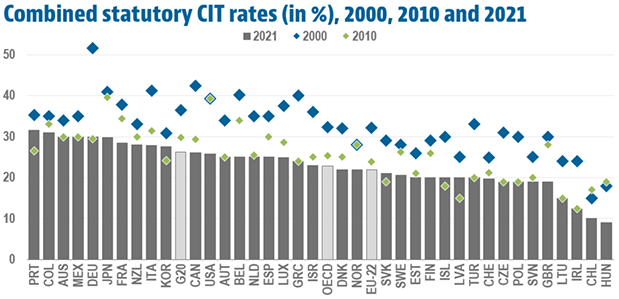

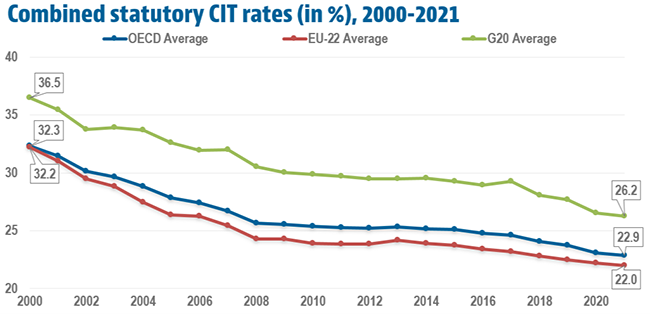

Corporate and capital income taxes

OECD member countries: Corporate and capital income taxes (2000-22)

- Statutory corporate income tax rates

- Targeted statutory corporate income tax rates

- Sub-central statutory corporate income tax rates

- Overall statutory tax rates on dividend income

Published: May 2022

Source: Country delegates to Working Party No.2 (Tax Policy and Tax Statistics)

of the OECD Committee on Fiscal Affairs

Explanatory notes

Each country provides detailed information on the data presented within the corporate income tax tables. This information can be found within the explanatory annex linked to below.

Inclusive framework: Corporate tax statistics and effective tax rates

The Corporate Tax Statistics database is intended to assist in the study of corporate tax policy and expand the quality and range of data available for the analysis of base erosion and profit shifting (BEPS).

Published: OECD member countries April 2022, inclusive framework data November 2022

Source: OECD Tax Database and OECD inclusive framework country questionnaires

Published: November 2022

Source: OECD Taxation Working Paper No. 38 (Hanappi, 2018).

Source: Forum on Harmful Tax Practices.

Explanatory notes

Further information on statutory corporate income taxes for certain jurisdictions:

Further methodological information on forward -looking effective tax rates:

Historical statutory corporate and capital income taxes (1981-99)

- Statutory corporate income tax rates (1981-1999)

- Targeted statutory corporate income tax rates (1981-1999)

- Sub-central corporate income tax rates (1981-1999)

- Overall statutory tax rates on dividend income (1981-1999)

Published: 2008

Source: Country representatives on the OECD Working Party 2: Tax Policy and

Tax Statistics of the Committee on Fiscal Affairs

Related publication: Taxation and Economic Growth

Table notes

Data for the years from 1981 to 1999 were collected as part of a special project. These data have not been verified since, but are made available to people who would wish to use them, and are aware of their possible limitations.

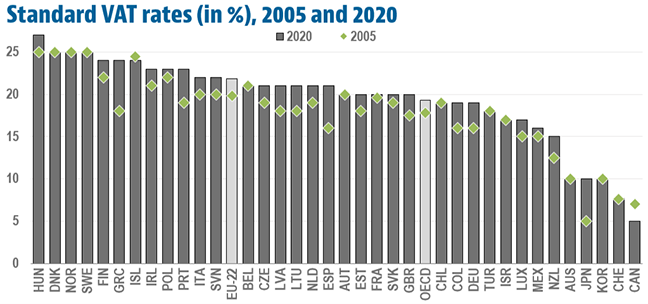

Taxes on consumption

The data on consumption taxes comes predominantly from the publication Consumption Tax Trends. It presents information on Value Added Tax/Goods and Services Tax (VAT/GST) and excise duty rates in OECD member countries. It also contains information about indirect tax topics such as international aspects of VAT/GST developments and the efficiency of this tax. It also describes a range of taxation provisions such as the taxation of motor vehicles, tobacco and alcoholic beverages.

Value Added Tax/Goods and Services Tax (VAT/GST) (1976-2023)

Published: Updated 2023

Source: Consumption Tax Trends: VAT/GST and Excise, Core Design Features and Trends

Table notes

Reporting both the applicable standard rate and any reduced rates. Specific countries notes.

Thresholds under which there is relief from VAT/GST registration and collection, as well as information on minimum registration periods etc.

Selected Excise Duties

- Taxation of Beer - (2022).

- Taxation of Wine - (2022).

- Taxation of Alcoholic beverages - (2022).

- Taxation of Tobacco - 2022).

- Tax burden as a share of total price for cigarettes - (2020).

- Taxation of premium unleaded gasoline per litre - (2022).

- Taxation of automotive diesel per litre - (2022).

- Taxation of light fuel oil for households per litre - (2022).

Source: Consumption Tax Trends: VAT/GST and Excise, Core Design Features and Trends

Consumption tax trends

Australia | Austria | Belgium | Canada | Chile | Colombia | Czech Republic | Denmark | Estonia | Finland | France | Germany | Greece | Hungary | Iceland | Ireland | Israel | Italy | Japan | Korea | Latvia | Lithuania | Luxembourg | Mexico | Netherlands | New Zealand | Norway | Poland | Portugal | Slovak Republic | Slovenia | Spain | Sweden | Switzerland | Türkiye | United Kingdom | United States |

Source: Consumption Tax Trends - VAT/GST and excise rates,

trends and policy issues

Tax and the environment

The tax and the environment unit provides detailed data on taxes and tradable permit systems that apply to domestic energy use. Average tax rates and permit prices are available for 42 OECD and G20 economies. Data on taxes is from Taxing Energy Use, whereas Effective Carbon Rates is the source of the information on emissions trading systems.

Carbon pricing country summaries

Argentina | Australia | Austria | Bangladesh | Belgium | Brazil | Burkina Faso | Canada | Chile | China | Colombia | Costa Rica | Côte d'Ivoire | Cyprus | Czech Republic | Denmark | Dominican Republic | Ecuador | Egypt | Estonia | Ethiopia | Finland | France | Germany | Ghana | Greece | Guatemala | Hungary | Iceland | India | Indonesia | Ireland | Israel | Italy | Jamaica | Japan | Kenya | Korea | Kyrgyzstan | Latvia | Lithuania | Luxembourg | Madagascar | Malaysia | Mexico | Morocco | Netherlands | New Zealand | Nigeria | Norway | Panama | Paraguay | Peru | Philippines | Poland | Portugal | Rwanda | Slovak Republic | Slovenia | South Africa | Spain | Sri Lanka | Sweden | Switzerland | Türkiye | Uganda | Ukraine | United Kingdom | United States | Uruguay

- Read the background notes (PDF)

- Access the underlying data (OECD.Stat)

Source: Pricing Greenhouse Gas Emissions: Turning Climate Targets into Climate Action

Effective carbon rates country summaries

Argentina | Australia | Austria | Belgium | Brazil | Canada | Chile | China | Czech Republic | Denmark | Estonia | Finland | France | Germany | Greece | Hungary | Iceland | India | Indonesia | Ireland | Israel | Italy | Japan |

| Korea | Latvia | Luxembourg | Mexico | Netherlands | New Zealand | Norway | Poland | Portugal | Russian Federation | Slovak Republic | Slovenia | South Africa | Spain | Sweden | Switzerland | Turkey | United Kingdom |

| United States |

Source: Effective Carbon Rates - Pricing CO2 through Taxes and

Emissions Trading Systems

Taxing Energy Use country summaries

Argentina | Australia | Austria | Belgium | Brazil |Canada | Chile | China | Czech Republic | Denmark | Estonia | Finland | France | Germany | Greece | Hungary | Iceland | India | Indonesia | Ireland | |Israel | Italy | Japan | Korea | | Latvia | Luxembourg | Mexico | Netherlands | New Zealand | Norway | Poland | Portugal | Russia | Slovak Republic | Slovenia | South Africa | Spain | Sweden | Switzerland | | Turkey | United Kingdom | United States |

Source: Taxing Energy Use

Taxing Energy Use for Sustainable Development

Costa Rica | Côte d'Ivoire (version française) | Dominican Republic | Ecuador | Egypt | Ghana | Guatemala | Jamaica | Kenya | Morocco (version française) | Nigeria | Philippines | Sri Lanka | Uganda | Uruguay

Source: Taxing Energy Use for Sustainable Development: Opportunities for energy tax

and subsidy reform in selected developing and emerging economies

Fiscal Decentralisation Database

The OECD fiscal decentralisation database provides comparative information on the following indicators analysed by level of government sector, (Federal or Central, including Social Security, State/Regional and Local) for OECD member countries between 1965 and 2016. Data contained in these tables have been obtained from the OECD National Accounts database, the OECD Revenue Statistics database and from individual countries through questionnaires.

Fiscal decentralisation database

The OECD fiscal decentralisation database provides comparative information on the following indicators analysed by level of government sector, (Federal or Central, including Social Security, State/Regional and Local) for OECD member countries between 1965 and 2016. Indicators including: Tax autonomy of state and local government, Classification of intergovernmental grants, Revenue and Spending shares of state and local governmen, Consolidated revenue, Tax revenue and Intergovernmental transfer expenditure.

Tax responses to COVID-19

With tax playing an important role in the response to the coronavirus (COVID-19) pandemic, the OECD has compiled the tax policy measures taken by governments to support households and businesses with the economic challenges of the crisis.

- Country tax measures during the COVID-19 pandemic (database, Xlsm), updated 22 April 2021

- Tax Policy Reforms 2021: Special Edition on Tax Policy during the COVID-19 Pandemic (report), published 21 April 2021

The database compiles the tax measures that countries implemented, legislated or announced in 2020 and early 2021. Data was collected from 66 countries, including all OECD and G20 countries, and 21 additional Inclusive Framework on BEPS members that replied to the OECD Tax Policy Reform Questionnaire. It contains information on countries’ tax measures across corporate income taxes and other business taxes, personal income taxes and social security contributions, value added taxes and other consumption taxes, environmentally related taxes, property taxes and other taxes.

- See latest tax administration and tax treaty measures

For more information, visit our dedicated COVID-19 platform: www.oecd.org/coronavirus/en/

Country summaries by publication

Taxing Wages

Australia | Austria | Belgium | Canada | Chile | Colombia | Costa Rica | Czechia | Denmark | Estonia | Finland | France | Germany | Greece | Hungary | Iceland | Ireland | Israel | Italy | Japan | Korea | Latvia | Lithuania | Luxembourg | Mexico | Netherlands | New Zealand | Norway | Poland | Portugal | Slovak Republic | Slovenia | Spain | Sweden | Switzerland | Türkiye | United Kingdom | United States

Source: Taxing Wages

Revenue Statistics OECD

Australia | Austria | Belgium | Canada | Chile | Colombia | Costa Rica | Czechia | Denmark | Estonia | Finland | France | Germany | Greece | Hungary | Iceland | Ireland | Israel | Italy | Japan | Korea | Latvia | Lithuania | Luxembourg | Mexico | Netherlands | New Zealand | Norway | Poland | Portugal | Slovak Republic | Slovenia | Spain | Sweden | Switzerland | Turkey | United Kingdom | United States |

Source: Revenue Statistics

Revenue Statistics in Latin America and the Caribbean

Argentina | Bahamas | Barbados | Belize | Bolivia | Brazil | Chile | Colombia | Costa Rica | Cuba | Dominican Republic | Ecuador | El Salvador | Guatemala | Guyana | Honduras | Jamaica | Mexico | Nicaragua | Panama | Paraguay | Peru | Saint Lucia | Trinidad and Tobago | Uruguay

Source: Revenue Statistics in Latin America and the Caribbean

En español

Argentina | Bahamas | Belice | Bolivia | Brasil | Barbados | Chile | Colombia | Costa Rica | Cuba | República Dominicana | Ecuador | Guatemala | Guyana | Honduras | Jamaica | Santa Lucía | México | Nicaragua | Panamá | Perú | Paraguay | El Salvador | Trinidad y Tobago | Uruguay

Fuente : Estadísticas tributarias en América Latina y el Caribe

Revenue Statistics Africa

Botswana | Burkina Faso | Cabo Verde | Cameroon | Chad | The Republic of the Congo | Côte d'Ivoire | The Democratic Republic of the Congo | Egypt | Equatorial Guinea | Eswatini | Gabon | Ghana | Guinea | Kenya | Lesotho | Madagascar | Malawi | Mali | Mauritania | Mauritius | Morocco | Namibia | Niger | Nigeria | Rwanda | Senegal | Seychelles | Sierra Leone | South Africa | Togo | Tunisia | Uganda

En français

Afrique du Sud | Botswana | Burkina Faso | Cabo Verde | Cameroun | Congo | Côte d'Ivoire | République démocratique du Congo | Égypte | Eswatini | Gabon | Ghana | Guinée | Guinée équatoriale | Kenya | Lesotho | Madagascar | Malawi | Mali | Maurice | Mauritanie | Maroc | Namibie | Niger | Nigeria | Ouganda | Rwanda | Sénégal | Seychelles | Sierra Leone | Tchad | Togo | Tunisie

Source: Revenue Statistics in Africa

Revenue Statistics in Asia and the Pacific

Armenia | Australia | Azerbaijan | Bangladesh | Bhutan | Cambodia | China | Cook Islands | Fiji | Georgia | Hong Kong (China) | Indonesia | Japan | Kazakhstan | Kiribati | Korea | Kyrgyzstan | Lao (PDR) | Maldives | Malaysia | Marshall Islands | Mongolia | Nauru | New Zealand | Pakistan | Papua New Guinea | Philippines | Samoa | Singapore | Solomon Islands | Sri Lanka | Thailand | Timor-Leste | Tokelau | Vanuatu | Viet Nam

Source: Revenue Statistics in Asia and the Pacific

Consumption tax trends

Australia | Austria | Belgium | Canada | Chile | Czech Republic | Denmark | Estonia | Finland | France | Germany | Greece | Hungary | Iceland | Ireland | Israel | Italy | Japan | Korea | Latvia| Lithuania | Luxembourg | Mexico | Netherlands | New Zealand | Norway | Poland | Portugal | Slovak Republic | Slovenia | Spain | Sweden | Switzerland | Türkiye| United Kingdom | United States |

Source: Consumption Tax Trends - VAT/GST and excise rates,

trends and policy issues

Carbon pricing

Argentina | Australia | Austria | Bangladesh | Belgium | Brazil | Burkina Faso | Canada | Chile | China | Colombia | Costa Rica | Côte d'Ivoire | Cyprus | Czech Republic | Denmark | Dominican Republic | Ecuador | Egypt | Estonia | Ethiopia | Finland | France | Germany | Ghana | Greece | Guatemala | Hungary | Iceland | India | Indonesia | Ireland | Israel | Italy | Jamaica | Japan | Kenya | Korea | Kyrgyzstan | Latvia | Lithuania | Luxembourg | Madagascar | Malaysia | Mexico | Morocco | Netherlands | New Zealand | Nigeria | Norway | Panama | Paraguay | Peru | Philippines | Poland | Portugal | Rwanda | Slovak Republic | Slovenia | South Africa | Spain | Sri Lanka | Sweden | Switzerland | Türkiye | Uganda | Ukraine | United Kingdom | United States | Uruguay

Source: Pricing Greenhouse Gas Emissions: Turning Climate Targets into Climate Action

Effective carbon rates

Argentina | Australia | Austria | Belgium | Brazil | Canada | Chile | China | Czech Republic | Denmark | Estonia | Finland | France | Germany | Greece | Hungary | Iceland | India | Indonesia | Ireland | Israel | Italy | Japan |

Korea | Latvia | Luxembourg | Mexico | Netherlands | New Zealand | Norway | Poland | Portugal | Russian Federation | Slovak Republic | Slovenia | South Africa | Spain | Sweden | Switzerland | Turkey | United Kingdom |

United States |

Source: Effective Carbon Rates - Pricing CO2 through Taxes and

Emissions Trading Systems

Taxing Energy Use

Argentina | Australia | Austria | Belgium | Brazil |Canada | Chile | China | Czech Republic | Denmark | Estonia | Finland | France | Germany | Greece | Hungary | Iceland | India | Indonesia | Ireland | |Israel | Italy | Japan | Korea | Latvia | Luxembourg | Mexico | Netherlands | New Zealand | Norway | Poland | Portugal | Russia | Slovak Republic | Slovenia | South Africa | Spain | Sweden | Switzerland | | Turkey | United Kingdom | United States |

Source: Taxing Energy Use

Taxing Energy Use for Sustainable Development

Costa Rica | Côte d'Ivoire (version française) | Dominican Republic | Ecuador | Egypt | Ghana | Guatemala | Jamaica | Kenya | Morocco (version française) | Nigeria | Philippines | Sri Lanka | Uganda | Uruguay

Source: Taxing Energy Use for Sustainable Development: Opportunities for energy tax

and subsidy reform in selected developing and emerging economies

Taxation and skills

Australia | Austria | Belgium | Canada | Chile | Czech Republic | Denmark | Estonia | Finland | Greece | Hungary | Iceland | Ireland | Israel | Italy | Luxembourg | Mexico | Netherlands | New Zealand | Norway | Poland | Portugal | Slovak Republic | Slovenia | Spain | Sweden | Switzerland | Turkey | United Kingdom |

Source: Taxation and skills