Direction de la Science, de la technologie et de l'innovation

Le projet microBeRD

Business R&D structure and dynamics and the impact of public support for business R&D

The OECD Directorate for Science, Technology and Innovation is working on a project that applies a “distributed” approach to the empirical analysis of business R&D micro-data. The OECD microBeRD project explores the structure, distribution and concentration of business R&D and sources of R&D funding across countries and models the incidence and impact of public support for business R&D. This approach, based on the collaboration with national experts with access to confidential R&D and public support micro-data, facilitates a co-ordinated statistical analysis of the impact of R&D tax relief design features, as well as their interaction with direct forms of public R&D funding, by exploiting the variation in government support within and across countries.

Microdata-based evidence on the impact of public support for business R&D

The microBeRD project investigates whether R&D tax incentives and direct funding are effective in stimulating additional R&D investment (“R&D input additionality”) by business using a novel, internationally distributed method of microdata-based impact analysis.

Latest news: Micro-data based insights on trends in business R&D performance and funding: Findings from the OECD microBeRD+ project. This September 2022 OECD STI Working Paper presents new insights on trends in business R&D performance and funding, drawing on the micro-aggregated R&D and tax relief statistics collected for 21 OECD countries as part of the OECD microBeRD project. Micro-aggregated statistics provide an important input for policy analysis, highlighting important variations in business R&D performance and funding across industries and different types of firms that are hard to uncover based on aggregate R&D and tax relief statistics. They shed light on country and industry specific trends in the concentration of R&D activity, business R&D dynamics, the structure of R&D performance among different types of firms and the way that they fund their R&D activities.

The September 2020 OECD STI Policy Paper "The Effects of R&D Tax Incentives and Their Role in the Innovation Policy Mix - Findings from the OECD microBeRD project, 2016-19" presents the results from the first phase. The results show that the effect of such measures varies across different types of firms and R&D expenditures, and shed light on the mechanisms driving these effects.

These findings, based on 20 OECD countries, have important policy implications and are summarised in a policy note  (also available in French)

(also available in French)

See also our October 2020 voxEU article "Effectiveness of R&D tax incentives in OECD economies".

A key finding of the cross-country analysis is presented below. This cross-country study based on micro-aggregated data complements the firm-level analysis undertaken within countries as part of the microBeRD project.

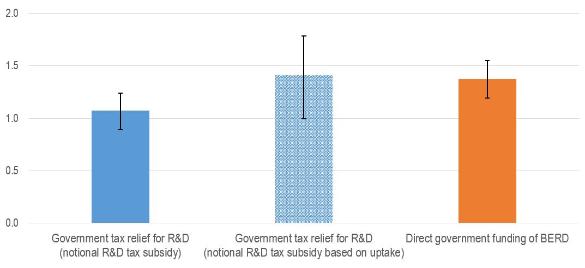

Estimated effectiveness of government support in raising business R&D

Amount of R&D induced by 1 EUR of support

Note: This figure displays the amount of R&D induced by EUR 1 of public support (gross incrementality ratio) by type of policy instrument. The whiskers mark the 90% confidence interval, which covers the “true” incrementality ratio with a probability of 90%.

Microdata-based indicators

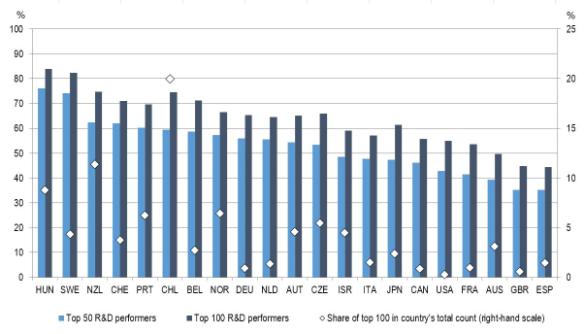

While it is broadly acknowledged that R&D is a highly concentrated activity, there is only limited internationally comparable evidence available on the degree of R&D concentration within OECD countries. microBeRD seeks to help close this evidence gap. The results from the latest microBeRD analysis of R&D performance across a number of OECD countries at the enterprise level highlight, for example, that the 50 largest domestic R&D performers account for 40% of BERD in France, Australia and the United States, 55% in Austria, the Czech Republic, Germany, the Netherlands and Norway, and 75% in Sweden and Hungary.

Concentration of business R&D: top 50 and top 100 performers, 2017 or nearest year

As a percentage of domestic business R&D expenditure or total count of performers

Note: Figures for the United States were calculated using the country's own procedures.

DATA AND METHODOLOGY

The project relies on a distributed microdata methodology, in a similar fashion to OECD MultiProd and DynEmp projects. A software is sent to countries, and affiliated researchers in each country run the code on their confidential microdata. This approach allows firm-level-based analysis while respecting confidentiality rules. It also ensures a high level of harmonisation, which allows comparability of results across countries.

The microdata distributed analysis relies on survey-based business R&D performance at this stage and will be extended to R&D tax relief micro data, where available and accessible for analytical purposes, among other relevant microdata sources (e.g. R&D grant, business innovation data) that may feed into the distributed analysis at a later stage.

THE MICROBERD PROJECT NETWORK

MicroBeRD is a joint project of the OECD Committee on Industry, Innovation and Entrepreneurship (CIIE) and the OECD Committee for Scientific and Technological Policy (CSTP) through its Working Party of National Experts on Science and Technology Indicators (NESTI). The project capitalises on NESTI's expertise in producing aggregate R&D and R&D government support indicators and experience of the OECD Directorate for Science, Technology and Innovation in carrying out international, distributed microdata projects.

Participants

- Australia

- Austria

- Belgium

- Canada

- Chile

- Czech Republic

- France

- Germany

- Hungary

- Israel

- Italy

- Japan

- Netherlands

- New Zealand

- Norway

- Portugal

- Spain

- Sweden

- Switzerland

- United Kingdom

- United States

Phase 2: microBerd +

The second phase of the project (microBeRD+, 2020-2023) will explore the effect of R&D support policies on innovation outputs (e.g. introducing new products and services, filing patents) and economic outcomes (e.g. employment and productivity growth). It will also refine the current analysis by further exploring the relationship between tax incentive design, additionality and the innovation support policy mix over time.

Related work and publications

- Measuring R&D tax support: Findings from the OECD Tax Incentives Database

- Measuring Tax Support for R&D and Innovation

- OECD DynEmp project: Measuring job creation by start-ups and young firms

- OECD Multiprod project: Uncovering the micro drivers of aggregate productivity

- Innovation in Firms: A Microeconomic Perspective

- OECD Main Science and Technology Indicators Database

Contact us: microberd@oecd.org

Documents connexes