Économie

Launch of OECD Scoreboard on Financing SMEs and Entrepreneurs 2015

|

Remarks by Angel Gurría Secretary-General, OECD IMF/WB & G20 Finance Ministers and Central Bank Governors Meeting Washington, DC, United States 16 April 2015 (As prepared for delivery)

It is a pleasure to be here today to launch the OECD Scoreboard on Financing SMEs and Entrepreneurs. |

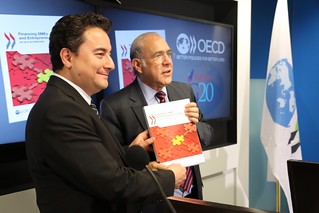

Ali Babacan, Deputy Prime Minister of Turkey and Angel Gurría, Secretary-General of the OECD at the launch of the OECD SME Scoreboard 2015, Washington, DC. |

|

Small and medium-sized enterprises are crucial for tracing new paths to more sustainable and inclusive growth, thanks to their role in providing employment. This is why I particularly welcome the Turkish Presidency’s emphasis on promoting SMEs development throughout the G20’s various streams, as part of its inclusiveness agenda. In the OECD area, SMEs provide the main source of employment and value creation, accounting for about 60 to 70% of employment and more than 50% of value added.

However, access to finance is a longstanding structural barrier to entrepreneurship and SME growth, and represents an important issue for G20 governments to tackle. It was a critical issue before the crisis; and unfortunately, the crisis made it worse. The OECD Scoreboard on Financing SMEs and Entrepreneurs, published annually, provides governments with the necessary information on the state of play with regard to their SMEs’ access to finance and current obstacles they face. Let me go through what we consider to be the key findings of this report and which we hope can guide the policy agenda.

First, more than seven years after this crisis, bank lending to SMEs has still not recovered to pre-crisis levels in many countries covered by the report. A common finding across the OECD was that SMEs were much more affected by the financial crisis than large firms.

This is the case in the countries most affected by the financial crisis such as Greece, Portugal and Spain. In Spain, for example, new lending to SMEs fell by almost 65% between 2007 and 2013. More surprisingly, in the United Kingdom and the United States SME lending has not returned to 2007 levels either, despite relative high GDP growth in recent years. In the United States, SME loans represented 22% of all business loans in 2013, down from 31% in 2007. Credit conditions also tightened significantly in the years after the crisis, and despite a recent loosening, they remain much tighter for SMEs than for large enterprises.

These credit restrictions for SMEs are here to stay, at least for the foreseeable future. As banks continue to deleverage to meet business and regulatory requirements, SMEs will keep struggling to obtain sufficient finance through bank lending. The rise in non-performing SME loans in the aftermath of the financial crisis – documented by the 2015 Scoreboard – constitutes an additional barrier to SME lending, particularly in the countries most affected by the financial crisis, notably in European peripheral countries: In Greece, for example, 31.8% of all SME loans were non-performing in 2013, up from 4.1% in 2007.

There is therefore a pressing need to enable SMEs to diversify their sources of finance – in this area, though, a quantum leap is needed.

The Scoreboard illustrates that alternative financing instruments - which include factoring, venture and growth capital, business angel investment, mini-bonds, mezzanine finance and crowdfunding – still represent only a very small source of SME funding globally and cannot compensate for a retrenchment of bank lending.

In the Euro area, only 7% of SMEs use (or are considering the use of) equity financing, compared with more than 60% which make use of bank loans and more than 50% which use overdrafts. In the United Kingdom, where SMEs have better access to financial markets than in the Euro area, traditional bank lending still accounted for 75% of gross funding of SMEs in 2014.

And like bank lending, many alternative instruments suffered as a result of the crisis. For example, in 2013 venture and growth capital investments in SMEs remained well below their 2007 levels in most countries. One notable exception is the United States, with levels of venture capital investments 38% higher in 2013 than in 2007.

In its work on “new approaches to SME and entrepreneurship financing”, the OECD has identified three key actions to support the development and uptake of a diverse set of finance instruments for SMEs:

However, governments are increasingly introducing schemes to encourage investments in equity, in recognition of the role of high-growth SMEs as drivers of economic competitiveness and development. Finland, Sweden and Turkey have all recently introduced tax break for equity investors, whereas Canada, Chile, among others, have significantly increased the budget to reinvigorate venture capital funds in recent years. Past experience shows that these types of policies can pay off. Israel, which today has the highest level of venture capital investments in the OECD, developed its venture capital industry through significant government spending at the outset, and by generous tax incentives for foreign investors.

Let me conclude my presentation on a positive note.

There were some encouraging signs that credit conditions for SMEs are gradually improving, largely as a consequence of the unprecedented monetary easing in many parts of the world. In the United States, for example, the average interest rate charged on a new credit facility to SMEs reached a record low of 3.5% in 2013, down from 8% in 2007.

We will continue to monitor the situation closely to see if improvements translate into more lending to SMEs.

A solid evidence base is the first prerequisite for getting SME finance policies right, and the OECD Scoreboard on Financing SMEs and Entrepreneurs is providing just that. Drawing on the latter, the OECD is ready to work with G20 governments to develop a set of principles to support SME finance, to enable these firms to make their best contribution to investment and innovation, employment and prosperity.

Thank you. |

|

Documents connexes