Financement pour le développement durable

Impact Standards for Financing Sustainable Development

|

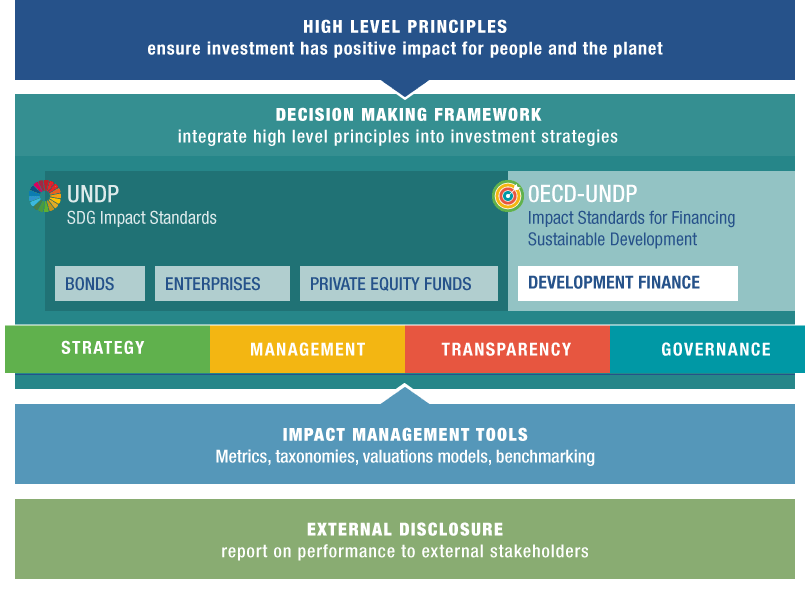

A decision-making framework for donors, development finance institutions (DFIs) & investors to deliver sustainable investments with integrity. |

|

||

How do the Standards add value to existing impact management principles, frameworks and tools?

|

||

The Four StandardsFor the purpose of these Standards, “partner” refers to any organisation deploying public or public/private capital through debt, equity or mezzanine instruments, as well as guarantees and other unfunded contingent liabilities for investments contributing to the SDGs. When a donor is investing directly, the “partner” is the donor itself. |

||

OECD-UNDP Impact Standards for Financing Sustainable Development

|

||

Guidance Notes on the Impact Standards for Financing Sustainable DevelopmentDetailed Implementation Guidance notes accompany the Impact Standards. The four Guidance Notes - one per each Standard - are intended to enhance meaningful alignment with the Standards themselves by providing clear and instructive guidance. In particular, they aim to support organisations in the process of revising their strategy, management approach, governance systems and transparency policies - and make them fit for achieving development impact and the SDGs. The Guidance Notes can be found here:

|

Documents connexes