Corporate governance and corporate finance

Stock markets are changing: Investors, companies and regulators must be prepared

27/11/2019 - Asia is rapidly growing into the world’s largest stock market. In 2018, 51% of all equity capital raised through initial public offerings (IPOs) went to Asian companies. Today more than half of the world’s listed companies are from Asia. This development is reshaping global stock market in several ways, according to a new OECD report: Households outside of Asia have increased their investments in Asian companies through pension funds, mutual funds and other intermediaries; it is increasingly common that listed companies are majority owned by the public sector or by other private companies; and smaller growth companies from Asia are using capital markets to raise money more extensively than smaller companies from the rest of the world.

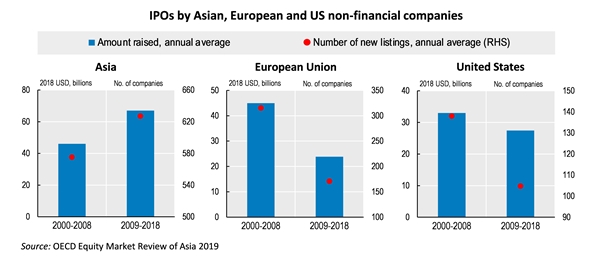

OECD Equity Market Review of Asia 2019 says that Asian non-financial companies raised an annual average of USD 67 billion during the last decade. This means that they surpassed the combined amount of equity raised by companies from Europe and the United States.

The development in Asia is largely due to a significant increase in the use of public equity markets by companies from China. Chinese companies have been the most frequent users of IPOs during the past decade, making twice as many IPOs as the US companies. However, it is not all about China. India, Korea and Japan also rank among the top 10 economies globally when it comes to the number of new stock market listings. Notably, several emerging markets, such as Viet Nam, Thailand, Indonesia and Malaysia, rank higher in terms of IPOs than most advanced economies. Many advanced economies have experienced a simultaneous decrease in the number of new listings and an increase in delistings. A development that inevitably has resulted in a decline in the overall number of publicly listed companies.

Another concern in many advanced economies is the changing character of the companies that use the stock markets. Historically, around 80% of all non-financial companies that made an IPO could be characterised as smaller “growth companies”. And it is a decrease in listings by these companies that to a large extent explains the overall decrease in the number of listed companies in advanced markets. In the United States, for example, the share of growth company listings compared to the total number of listings has declined from almost 80% during the period 1995-1999, to around 50% since 2000. A similar trend can be observed in Germany and to some extent in the United Kingdom.

Despite the decline in the number of listed companies, the total market value of listed companies to GDP has increased in many advanced economy markets over the recent years. This is largely because these markets host a smaller number of larger companies. The average market value of listed companies in some markets has actually doubled in real terms over the past two decades.

Another important feature of today’s stock markets is that they have become more integrated and that a growing share of public equity investments are being made across borders. Continued strong IPO activity in Asia and an increasing weight of Asian companies in the global stock market indices would further increase the size of foreign equity portfolio investments in Asia. But Asian companies have also taken advantage of other means to directly attract new capital from abroad, notably through foreign listings. At the end of 2018, there were 600 Asian companies listed on foreign markets.

As a result of growing Asian stock markets, households outside of Asia have through their pension funds, mutual funds, insurance companies, increased their equity investments in Asian companies. Not only in the form of cross-border portfolio investments but also through investments in Asian companies that have listed abroad.

Publicly traded equity as an asset class – with a global value of around USD 85 trillion - still dwarfs all other markets based investment opportunities that are readily available to the general public. This means that ordinary households directly or indirectly heavily rely on public equity markets to protect and increase the value of their savings.

The global integration of equity markets means that investors can benefit from investment opportunities beyond their own national borders and that companies can get finance from a much larger pool of investors. But it also leads to important changes in stock markets, to which investors, companies and regulators from different legal, regulatory, economic and cultural traditions must prepare and adapt.

Download OECD Asia Equity Market Review of 2019.

For further information, journalists can contact Mats Isaksson, Head of Corporate Governance and Corporate Finance, (tel. + 33 1 45 24 76 20) or Serdar Çelik, Senior Economist, (tel. + 33 1 45 24 79 84) in the OECD’s Directorate for Financial and Enterprise Affairs.

Working with over 100 countries, the OECD is a global policy forum that promotes policies to improve the economic and social well-being of people around the world.

Related Documents