Times of crisis and opportunity

The STI policy mix needs to be more targeted

The current crisis serves as a reminder that policy needs to guide innovation efforts to where they are most needed. Governments need to build innovation support portfolios that equip them with mechanisms, instruments and capabilities to direct innovation efforts, especially for tackling pressing societal challenges. Given that firms carry out close to 70% of R&D in the OECD area, recovery packages will need to include a mix of measures that direct private-sector innovation efforts towards sustainability and resiliency goals, especially in cases where market signals prove insufficient and co-ordination is challenging. Policy measures should reduce uncertainties by signalling intended public sector investments and future demand commitments.

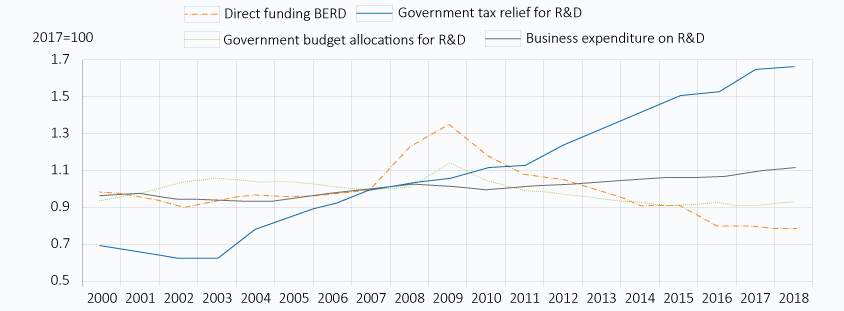

Shift in business R&D support policy mix, 2000-18

Government funding of R&D in the OECD area, indexed values for key figures normalised by GDP, 2007=1

Source: OECD R&D Tax Incentives Database, http://oe.cd/rdtax, November 2020). StatLink https://doi.org/10.1787/888934223403

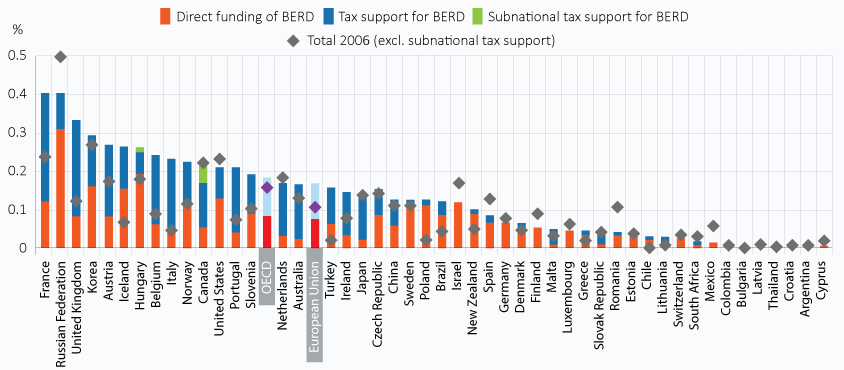

With the increasing proliferation and generosity of R&D tax incentives across OECD countries and partner economies over the last decades (Figure 10), the business R&D support policy mix has shifted towards a greater reliance on tax compared to direct support instruments (such as contracts, grants or awards). Across OECD countries, tax support represented around 55% of total government support in 2017, compared to 36% in 2006 (Figure 11). While effective for incentivising businesses to innovate, R&D tax incentives are indirect and untargeted, and tend to generate incremental innovations. Well-designed direct measures for R&D are potentially better suited to supporting longer-term, high-risk research, and to targeting innovations that either generate public goods (e.g. in health) or have a high potential for knowledge spillovers. Governments should also link support for emerging technologies to broader public policy missions that encapsulate responsible innovation principles.

Direct government funding and government tax support for business R&D, 2018

As a percentage of GDP

Source: OECD R&D Tax Incentives Database, http://oe.cd/rdtax, December 2020. StatLink https://doi.org/10.1787/888934223422

- The STI policy mix needs to be more targeted

- Government R&D expenditures may need to shift to reflect new priorities

- Growing government debt could lead to austerity, and some hard choices for research and innovation policy

- Postgraduate training regimes need reforming to support a diversity of career paths

- Global challenges require global solutions

- Building government capabilities to meet future challenges will be a major challenge in itself

‹ Homepage

Related Documents

- Postgraduate training regimes need reforming to support a diversity of career paths

- Responses to the crisis have drawn upon the innovative potential of businesses

- The pandemic has triggered an unprecedented mobilisation of the scientific community

- Growing government debt could lead to austerity, and some hard choices for research and innovation policy

- Government R&D expenditures may need to shift to reflect new priorities

- Much of the research and innovation response to COVID-19 has been international

- Business research and innovation have been affected unevenly by the crisis

- Building government capabilities to meet future challenges will be a major challenge in itself

- Global challenges require global solutions

- Despite the disruption, scientists have continued their work during the crisis

- Governments acted quickly to fund COVID-19-related research and innovation at scale