National accounts

Why do deflators matter when looking at growth and economic well-being?

24 Nov 2022 - Our news release on economic growth and well-being in the second quarter of 2022 showed real Household Disposable Income (HDI) per capita in the OECD declining by 0.5% while real Gross Domestic Product (GDP) per capita rose by 0.3%. The decrease in real HDI per capita was partly due to high inflation: increases in consumer prices were undermining household income in real terms.

Real HDI per capita provides a better indicator of household economic well-being than real GDP per capita because it is a measure of household income, and it is deflated using price changes for the household sector (consumers). Since GDP relates to the economy as a whole, changes in prices may be driven by components that do not directly affect households.

GDP and HDI as measures of income

HDI is income received by households including income from employment, pensions and other social benefits, and income from the ownership of financial assets. It is ‘disposable’ income because it is what households have left after subtracting from their income any taxes on income and wealth, social contributions, and payments relating to financial liabilities.1

GDP, the measure of the production in the economy as a whole, also measures the income generated from that production and paid to those involved, for example through wages and salaries, income from self-employment and company profits. There is usually a strong relationship between growth in GDP and growth in HDI over time,2 but this relationship may not hold when there is severe economic disruption or when households receive significant increases in government support, as was the case during the initial stages of the pandemic.

In our news releases, GDP and HDI growth are presented in ‘real terms’: adjusted to remove increases (or decreases) in prices.3 Therefore, divergences may also be partly due to differences in inflation rates experienced by the economy as a whole and those recorded for private consumption, the relevant price index for the household sector.

Deflating GDP and HDI

In order to produce real GDP and real HDI estimates, the nominal estimates of GDP and HDI must be deflated. GDP is deflated using price indices that reflect the different components of GDP: domestic production, consumption, capital formation (investment), imports and exports. The impact of the price change of each component on the aggregate price deflator depends on how much each component contributes to GDP.4

It is difficult to deflate HDI in the same way.5 Instead, the OECD deflates total HDI using the change in the implicit price deflator (IPD) for total private consumption of households.6 Thus, real HDI is presented in consumption equivalents, reflecting households’ purchasing power of consumption goods and services.

Figure 1 shows the IPDs for private consumption and for GDP in the second quarter of 2022 for the G7 countries and the OECD. The two IPDs are similar for the OECD as a whole, but in France, Germany, Italy and the United Kingdom the IPD for GDP was lower than the IPD for private consumption. By contrast, in the United States and Canada the IPD for GDP was higher than the private consumption IPD, as households faced lower price increases than in the economy as a whole.

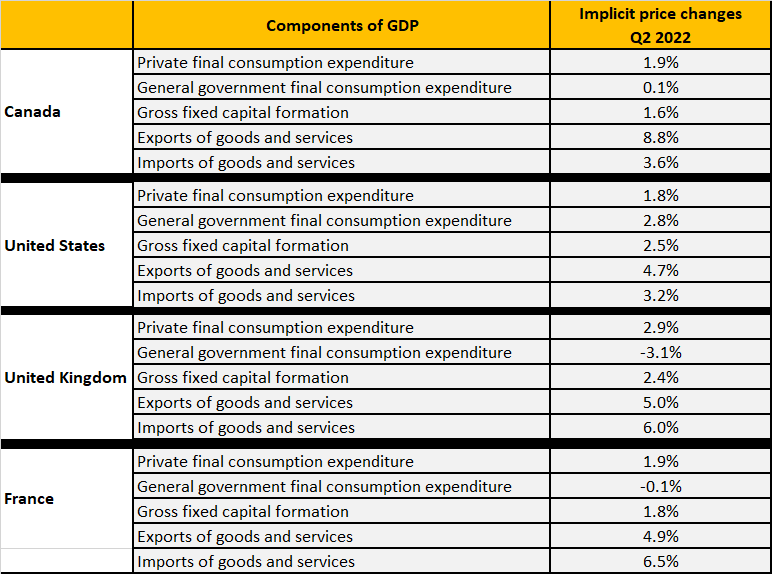

The GDP deflator or IPD reflects the changes in prices of the components of GDP: private consumption (‘private final consumption expenditure’), government consumption (‘general government final consumption expenditure’), investment (‘gross fixed capital formation’) and the terms of trade (exports of goods and services divided by imports of goods and services). Examples for Canada, the United States, the United Kingdom and France are shown in Table 1.

Table 1: Implicit price changes of GDP components, Canada, the United States, the United Kingdom and France, Q2 2022

Percentage change on the previous quarter

Source: OECD (2022), Quarterly National Accounts: Volume and price indices - GDP expenditure approach (database)

The GDP deflator is a weighted average of the price changes of the components of GDP. Figure 2 shows the contribution of each component to the GDP deflator or IPD, in percentage points (ppts), for Canada, the United States, the United Kingdom and France in Q2 2022. Canada recorded the highest GDP deflator, largely due to the positive change in the terms of trade. Prices of exports rose, contributing 3.0ppts to the change in Canada’s GDP IPD and more than offsetting the impact of rising import prices, which subtracted 1.2ppts. In the United States, the combined impact of export and import prices on the overall GDP deflator was very small (0.1ppts). Although export prices increased more than import prices, partially driven by the strength in the US dollar, imports have more weight than exports in the United States GDP deflator, so their contribution offset the impact of rising export prices. Private consumption (1.2ppts) was the largest contributor to the United States GDP deflator.

Despite recording the largest positive contribution from private consumption (1.4ppts), the United Kingdom saw a relatively low increase in the GDP deflator in Q2 2022. This was due to a decline in the terms of trade and a decrease in the price of government consumption (the cost of delivering government services, such as health and education), which each subtracted 0.6ppts from the GDP deflator. In France, the positive impact of private consumption was almost entirely offset by a decline in the terms of trade, resulting in the lowest increase in the GDP deflator of the G7 countries.

How the price changes affected GDP and HDI

The impact of different measures of price change is best shown by continuing the comparison between the four countries (Figure 3). On a nominal basis, Canada’s 3.9% GDP per capita growth in Q2 2022 was much higher than France (0.7%) . However, on a real basis, GDP per capita growth in these two countries was closer (0.5% and 0.4% respectively), reflecting the fact that prices for the economy as a whole rose faster in Canada than in France. Despite nominal GDP per capita growth in the United Kingdom (1.4%) being lower than the 2.0% recorded in the United States in Q2 2022, growth in real GDP per capita remained positive in the United Kingdom at 0.2%, while in the United States it fell by 0.2%, reflecting higher price increases.

The picture was different when viewed from the household perspective. The United Kingdom recorded 1.8% growth in HDI per capita on a nominal basis, more than double the figure for Canada (0.8%) and France (0.7%). However relatively rapid growth in consumer prices in the United Kingdom meant that when measured on a real basis, taking into account the price changes faced by households, HDI per capita declined at almost the same rate in all three countries (-1.1% in Canada and the United Kingdom, and -1.2% in France). The United States saw nominal HDI per capita growth of 1.4%, but less of a decline in real HDI per capita (-0.4%).

Conclusion

Movements in real GDP and real HDI are often similar, even though GDP relates to the economy as a whole and HDI is for a specific sector of the economy – the household sector. However, divergences may occur, particularly when there is severe economic disruption. The reasons for such divergences may include differences in the price changes faced by consumers in the household sector and the price changes in the components of GDP, which feed into the GDP deflator. The latest trends in real GDP and real HDI are presented in our quarterly news releases on growth and economic well-being.

_______________________________

1. Technically, HDI is “the balancing item in the secondary distribution of income account” (SNA§ 8.20). This means that all payments and receipts recorded in both the primary income account and secondary distribution account need to be taken into consideration for its calculation. Beyond income from productive activities, this list includes income from pensions and other social benefits, such as unemployment or other government payments (less any payments of tax and social insurance contributions), income from financial investments (less interest paid on financial liabilities), income from insurance claims and miscellaneous receipts (less any insurance premiums and miscellaneous payments i.e. donations).

2. In 2016, the OECD released a working paper looking at the correlation of growth of GDP and HDI. This showed that over the long run (1996-2013) growth in the two indicators was similar for a majority of OECD countries.

3. By contrast, if we presented growth estimates on a nominal basis, these would reflect increases (or decreases) in both price and quantity.

4. Deflation can and does occur at a much more granular level than this. For example, private consumption is deflated using hundreds and thousands of different goods and services consumed by the ‘average’ household.

5. A price index relies on a consistent unit of quantity. It is hard to quantify a unit of operating surplus, taxes, interest or dividends.

6. IPDs are obtained by dividing the nominal estimate of an economic indicator (in this case private consumption expenditure) by the equivalent real estimate. The index generated reflects the aggregate price change for the indicator.

Contact

For further information, please contact the OECD Statistics and Data Directorate at stat.contact@oecd.org.

Follow us

|

@OECD_Stat |  |

OECD Statistics |

Related Documents