Industry and globalisation

Gross output flows in global value chains

Gross output flows in Global Value Chains: New indicators to evaluate countries’ reliance on foreign intermediate inputs

The OECD has produced new GVC indicators based on gross output trade to evaluate countries’ reliance on foreign intermediate inputs. The new data series are available for each country and sector of the ICIO data.

Compared with Trade in Value-Added (TiVA) indicators, gross output indicators reflect that systemic GVC shocks, such as natural disasters or geopolitical events, typically disrupt the entire, i.e. accumulated, value of the shipment of a good, rather than only the value added in the disrupted country. As many inputs cross borders multiple times, the measures inherently involve some double counting. Like TiVA indicators, they can reflect both direct trade links (“face value” exposure) in the production network, as well as total direct and indirect trade links (“look through” exposure). Breaking apart the indirect from the direct trade links also provides information on the share of exposure that is “hidden” in the sense that it happens because of higher order trade links.

The Foreign Input Reliance (FIR) and Foreign Market Reliance (FMR) indicators are based on the original work of Baldwin and Freeman (2022), while the different measures of Foreign Production Exposure – Import Side (FPEM) and Foreign Production Exposure – Export Side (FPEX) – are developed in Baldwin, Freeman and Theodorakopoulos (2022, 2023).

The indicators were generated using the 2023 release of the OECD annual Inter-Country Input-Output (ICIO) tables, which cover the period 1995 to 2020. The indicators are provided for 76 economies (including all OECD, European Union, ASEAN and G20 countries) and for 45 unique industries and related aggregates based on the ISIC Rev. 4 classification.

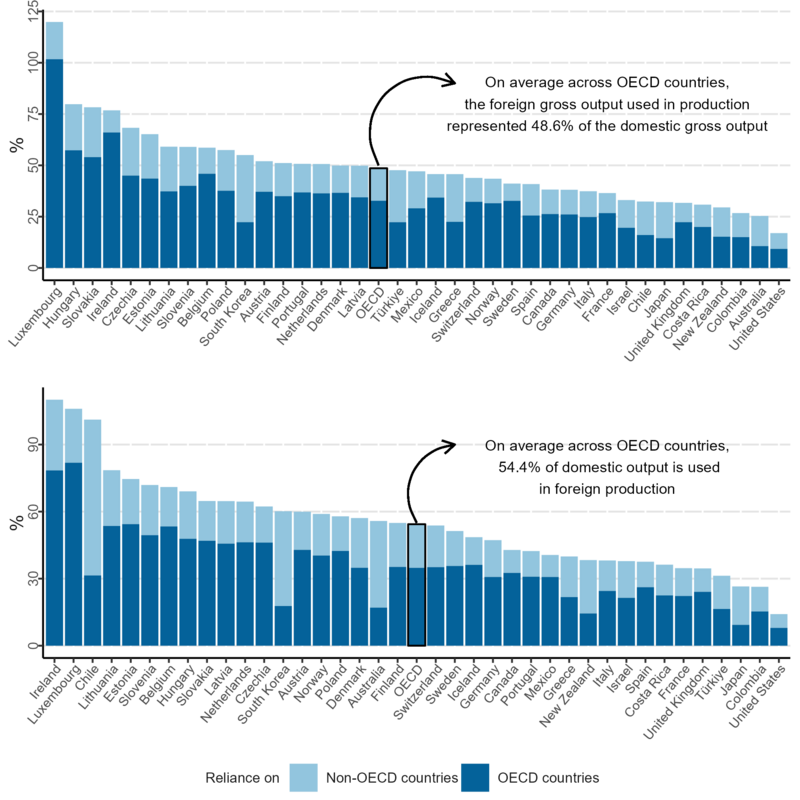

Foreign Input Reliance (FIR) and Foreign Market Reliance (FMR)

The FIR and FMR indicators account for the fact that disruptions faced by foreign suppliers and clients can happen through both direct trade links and higher order links, both of which could impact domestic production. They account for (and sum across) gross output linkages between different nodes of the production network. With this accounting framework, gross output flows between countries A and B can be counted several times given the multiple (downstream or upstream) production stages, and the fact that output from country A can indirectly cross several borders (e.g., between countries B and C). One important implication is that this GVC accounting methodology can result in indicators potentially exceeding values of 1.

FIR and FMR can be interpreted as the share of total domestic output exposed to foreign disruptions in GVCs, upstream for FIR and downstream for FMR. Overall, both FIR and FMR account for: (1) the size of exposure to a partner in the value chain; and (2) the distance to this partner in the value chain, i.e. the length of the value chain.

The indicators were developed in Baldwin and Freeman (2022) and have been featured in two OECD papers (Schwellnus et al. 2023, as well as Schwellnus, Haramboure and Samek, 2023) that illustrate how the indicators can be used both for descriptive and more analytical work.

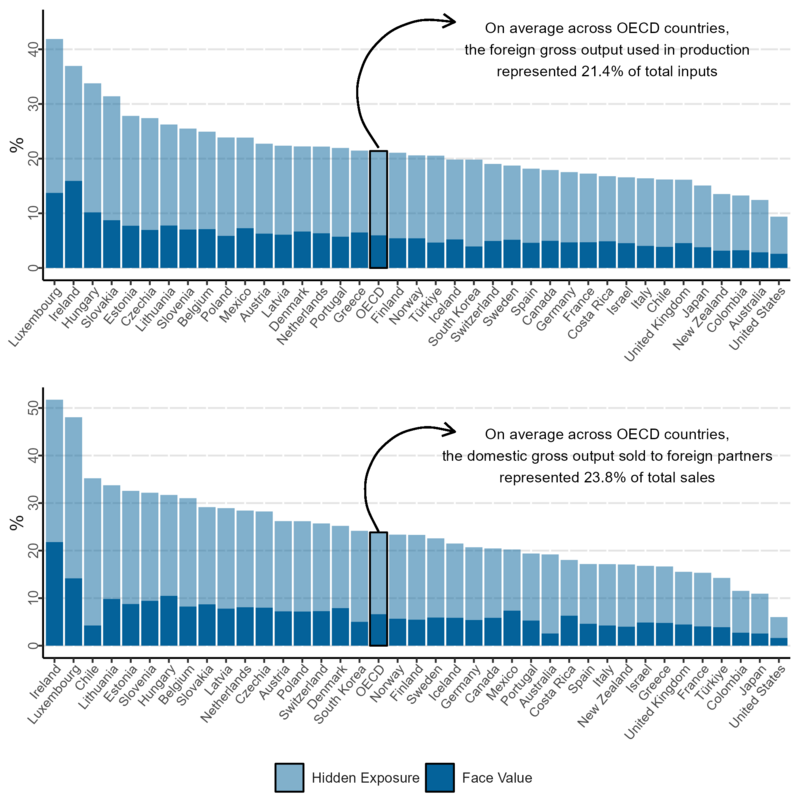

Foreign Production Exposure – Import Side (FPEM) and Foreign Production Exposure – Export Side (FPEX)

FPEM-look through and FPEX-look through are import and export side measures, respectively, which capture a country’s exposure to inputs sourced from/sent to foreign trade partners through direct and indirect trade links. The term ‘look through’ refers to the fact that the indicators allow to pierce the veil of the supply network of suppliers supplying suppliers, on the one hand, and the sales network of sellers selling to sellers, on the other.

FPEM and FPEX are gross trade indicators, meaning that the intermediate inputs sourced from/sent to a specific partner country may be counted more than once when goods or services cross borders multiple times. Both indicators are normalised (by total inputs – domestic and foreign – on the sourcing side, and total sales – domestic and foreign – on the selling side). This ensures that they range between 0% and 100% and thus can provide a clear indication of how big any given exposure is in relative terms.

Total trade links are made up of two components: (1) those which are direct, for example inputs sent from country A to country B directly; and (2) those which are indirect, for example inputs sent from country A to country B via country C.

FPEM-look through and FPEX-look through capture the totality of these different trade links. They have also been decomposed into their respective components: “face value” trade, which captures direct links only, and “hidden exposure” which captures indirect links only.

The face value measures are the share of FPEM-look through and FPEX-look through that is due to direct trade links while the hidden exposure measures are the share of FPEM-look through and FPEX-look through that is due to indirect trade links. These indicators, as well as other supply chain exposure measures, were developed in Baldwin, Freeman and Theodorakopoulos (2022, 2023).

FIR-FMR indicators

FPEM-FPEX indicators

Access to documentation and indicators

Contact Any suggestions or queries can be sent to STI.GVCResearch@oecd.org.

References

Baldwin, R. and R. Freeman (2022), “Risks and Global Supply Chains: What We Know and What We Need to Know”, Annual Review of Economics, Vol. 14/1, pp. 153-180, https://doi.org/10.1146/annurev-economics-051420-113737.

Baldwin, R., R. Freeman and A. Theodorakopoulos (2022), “Horses for Courses: Measuring Foreign Supply Chain Exposure”, NBER Working Paper No. 30525, https://doi.org/10.3386/w30525.

Baldwin, R., R. Freeman and A. Theodorakopoulos (2023), “Hidden Exposure; Measuring U S Supply Chain Reliance”, Brookings Papers on Economic Activity, https://www.brookings.edu/articles/hidden-exposure-measuring-us-supply-chain-reliance/.

Schwellnus, C., A. Haramboure and L. Samek (2023), “Policies to strengthen the resilience of global value chains: Empirical evidence from the COVID-19 shock”, OECD Science, Technology and Industry Working Papers.

Schwellnus, C., A.,Haramboure, L., Samek, R. Chiapin Pechansky and C. Cadestin (2023), “Global value chain dependencies under the magnifying glass”, OECD Science, Technology and Industry Policy Papers, https://doi.org/10.1787/23074957.

Related Documents