Newsroom

New OECD report shows loans to SMEs hit new heights during the pandemic, as small firms face renewed pressures during the recovery

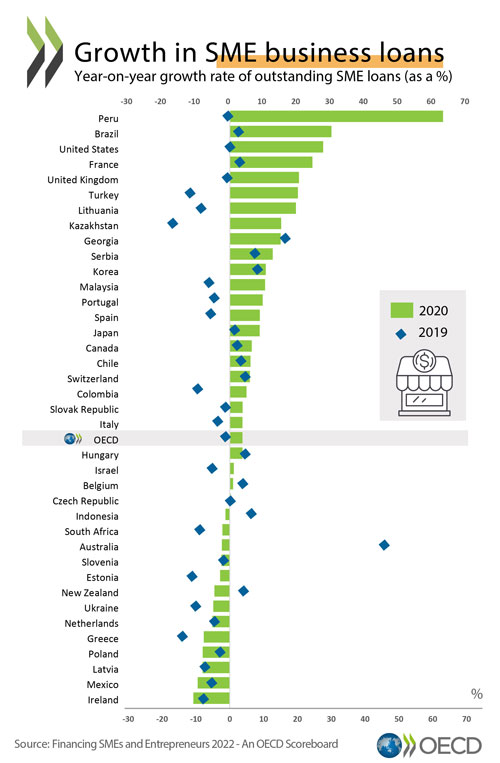

29/03/2022 -A new OECD report, “Financing SMEs and Entrepreneurs 2022: An OECD Scoreboard” shows that outstanding SME loans increased significantly during the first year of the pandemic. The median stock of SME loans increased by 4.9%, the highest upturn registered since the OECD Scoreboard was created 10 years ago1. This was underpinned by a strong increase in government-provided loan guarantees (up 110% y-o-y in 2020), debt moratoria, as well as direct lending to SMEs (up by 17% y-o-y in 2020).

29/03/2022 -A new OECD report, “Financing SMEs and Entrepreneurs 2022: An OECD Scoreboard” shows that outstanding SME loans increased significantly during the first year of the pandemic. The median stock of SME loans increased by 4.9%, the highest upturn registered since the OECD Scoreboard was created 10 years ago1. This was underpinned by a strong increase in government-provided loan guarantees (up 110% y-o-y in 2020), debt moratoria, as well as direct lending to SMEs (up by 17% y-o-y in 2020).

Emergency support measures – including monetary policy interventions by central banks – also pushed interest rates down to record lows, with the median SME interest rate of Scoreboard countries falling by 0.4 percentage points in 2020, the largest reduction since 2009.

In most economies covered by the Scoreboard, unprecedented support measures helped avoid a wave of insolvencies: in median terms, bankruptcies fell by 11.7% in Scoreboard countries in 2020. As countries phase out support measures – and firms see increased pressure from energy costs – bankruptcies and insolvencies are expected to increase going forward.

The report says it is vital that government recovery packages continue to provide targeted support to viable SMEs and entrepreneurs in need. The war in Ukraine, and the resulting humanitarian and economic crisis, reinforce the importance of support and access to financing for SMEs and entrepreneurs.

SMEs make a major contribution to the labour market and have the potential to play a key role in driving the green transition and in ensuring energy security. The report says they need access to a broader range of financial tools and instruments to strengthen their resilience.

Speaking at the report’s launch, OECD Secretary-General Mathias Cormann said “Support measures and favourable lending conditions have left many SMEs with higher levels of debt that will need to be tackled going forward. In particular, SMEs need better access to alternative financing instruments to reduce their dependence on debt and provide greater flexibility and resilience in these volatile economic times.”

SMEs account for the majority of employment and output across OECD economies. They will need to thrive if we are to succeed in securing a recovery that is strong, sustainable and resilient. However, SMEs have received relatively less attention in national recovery packages than during the crisis. According to OECD analysis, SME support through debt, grants and deferral instruments amounted to USD 32 billion (or 4.5% of total support) in recovery packages, compared to more than USD 3,136 billion (40% of total support) in previous measures taken to support SME’s weather the immediate effects of the pandemic.

Read More on OECD Work on “Financing SMEs and Entrepreneurs 2022: An OECD Scoreboard”.

More information about OECD work on SMEs is available here www.oecd.org/cfe/smes/.

For further information, journalists are invited to contact Shayne MacLachlan at Shayne.MACLACHLAN@oecd.org or the OECD Media Office (news.contact@oecd.org).

Working with over 100 countries, the OECD is a global policy forum that promotes policies to preserve individual liberty and improve the economic and social well-being of people around the world.

1 Countries reporting data for the Scoreboard are Australia, Austria, Belarus, Belgium, Brazil, Canada, Chile, the People’s Republic of China, Colombia, the Czech Republic, Denmark, Estonia, Finland, France, Georgia, Greece, Hungary, Indonesia, Ireland, Israel, Italy, Japan, Kazakhstan, Korea, Latvia, Lithuania, Luxembourg, Malaysia, Mexico, the Netherlands, New Zealand, Peru, Poland, Portugal, the Russian Federation, Serbia, the Slovak Republic, Slovenia, South Africa, Spain, Sweden, Switzerland, Thailand, Turkey, Ukraine, the United Kingdom and the United States.

Related Documents

- KMU-Kredite haben in der Pandemie neue Höchststände erreicht – während der Erholung ist mit neuen Belastungen zu rechnen

- Un nuevo informe de la OCDE muestra que los préstamos a las pymes alcanzaron niveles inéditos durante la pandemia, al tiempo que las pequeñas empresas se enfrentan a presiones adicionales durante la recuperación