Economics and policies for biodiversity: OECD's response

Project on Developing a Supervisory Framework for Financial Risks Stemming from Biodiversity-related Losses

|

Biodiversity and ecosystem services underpin all economic activities and human well-being, yet biodiversity is being destroyed at an unprecedented rate, posing significant risks to the economy and financial sector. Biodiversity-related financial risks, dependencies and impacts remain systematically mispriced by the financial sector, leading to its exposure to financial-related risks. Central banks and supervisors need to better understand, assess and manage biodiversity-related financial risks, with respect to central bank operations, collateral frameworks, financial stability and banking supervision. |

|

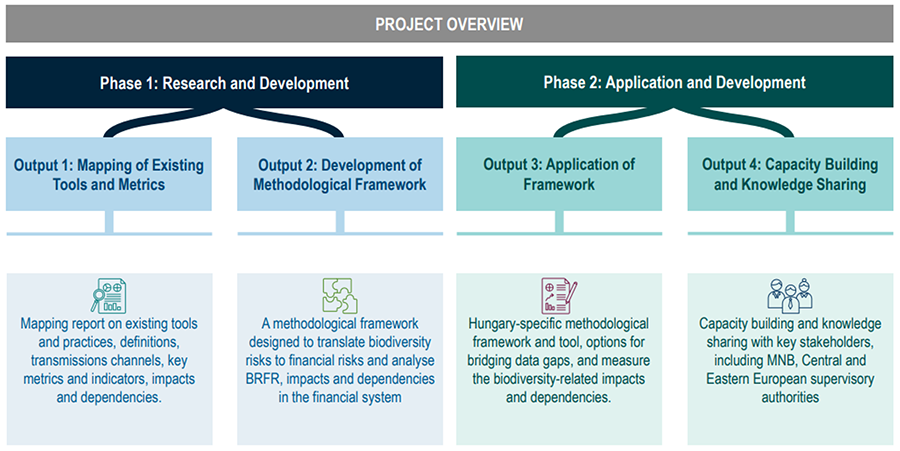

PROJECT OVERVIEW

The Project will develop a supervisory framework to help the Hungarian central bank (MNB) and other central banks assess biodiversity-related financial risks in the financial system, including transmission channels for physical and transition risks. The Project will aim to help MNB and banks with retail activities in Hungary become more informed about their exposures, impacts and dependencies to biodiversity-related financial risks, to improve management of such risks.

The Project will be undertaken two phases:

- Phase 1 (11 months) will result in a methodological framework designed to translate biodiversity risks to financial risks, drawing on a mapping of existing tools, practices, definitions, transmission channels, metrics and indicators. This conceptual framework will be relevant across country contexts for central banks, supervisors and retail banks. The Project will also involve engaging with key stakeholders to assess data needs and gaps.

- Phase 2 (11 months) of the Project will involve collection of available data, providing options for bridging data gaps, development of a software-based tool to implement the methodological framework to analyse the biodiversity-related financial risks, impacts and dependencies of the Hungarian financial system, and report on applicability. The Project will also involve communicating key findings to banks, MNB, EU and in particular Central and Eastern European supervisors and broader OECD policy communities. This is expected to help MNB introduce policies to improve financial resilience and stability of the Hungarian financial system, assess limit banks’ unmanaged risk taking and support sustainable economic development by counteracting biodiversity loss.

Project Outputs

- TAIEX TSI MNB-OECD-EC Launch Event: Technical implementation of the Supervisory Framework for Assessing Nature-related Financial Risks to the Hungarian financial sector | June 2024 | Agenda, PowerPoint presentations

- A supervisory framework for assessing nature-related financial risks: Identifying and navigating biodiversity risks | September 2023 | PowerPoint presentation

- OECD-INSPIRE workshop: Assessing biodiversity-related risks, impacts and dependencies in the financial sector | April 2023

- Policy Paper: Assessing biodiversity-related financial risks. Navigating the landscape of existing approaches | April 2023

ORGANISATION OF THE PROJECT

The organisational set-up of this 22-month project ensures coordination and cooperation between the DG REFORM, the MNB and the OECD. On the OECD side, the project is being jointly undertaken by the OECD Committee on Financial Markets (CMF) and the Working Party on Biodiversity, Water and Ecosystems (WPBWE) and Working Party on Climate, Investment and Development (WPCID) of the Environment Policy Committee (EPOC).

CONTACT POINTS

OECD: biodiversityfinancialsector@oecd.org

- Ms. Geraldine Ang, Project Manager and Senior Policy Analyst, OECD

- Mr. Hugh Miller, Policy Analyst, OECD

- Mr. Riccardo Boffo, Policy Analyst, OECD

- Mr. Gurcan Gulersoy, Policy Analyst, OECD

- Mr. Juan Pavajeau Fuentes, Young Associate, OECD

European Commission

- Ms. Kasia Kornosz-Koronowska, Policy Officer, DG REFORM, European Commission

Central bank of Hungary , Magyar Nemzeti Bank (MNB)

- Mr. David Papp, Head of Unit, Sustainable Finance Policy, MNB

- Ms. Katalin Juhasz, Analyst, MNB

RELEVANT LINKS

ABOUT THE OECD

The Organisation for Economic Co-operation and Development (OECD) is an international organisation that works to build better policies for better lives. The goal of the OECD is to shape policies that foster prosperity, equality, opportunity and well-being for all. We draw on 60 years of experience and insights to better prepare the world of tomorrow. Together with governments, policy makers and citizens, the OECD works on establishing evidence-based international standards and finding solutions to a range of social, economic and environmental challenges. From improving economic performance and creating jobs to fostering strong education and fighting international tax evasion, the OECD provides a unique forum and knowledge hub for data and analysis, exchange of experiences, best-practice sharing, and advice on public policies and international standard-setting.

ABOUT THE DIRECTORATE-GENERAL FOR STRUCTURAL REFORM SUPPORT OF THE EUROPEAN COMMISSION

The Directorate-General for Structural Reform Support (DG REFORM) helps EU countries to design and implement reforms as part of their efforts to support job creation and sustainable growth. DG REFORM coordinates and provides tailor-made technical support to EU Member States, in cooperation with the relevant Commission services. The support is primarily provided through the Technical Support Instrument (TSI). The goal is to support Member States’ efforts to design and implement resilience-enhancing reforms, thereby contributing to the EU’s recovery from the COVID-19 crisis, improving the quality of public services and getting back on the path of sustainable and inclusive growth.

Related Documents