Country reviews and advice

Monitor tax reform trends

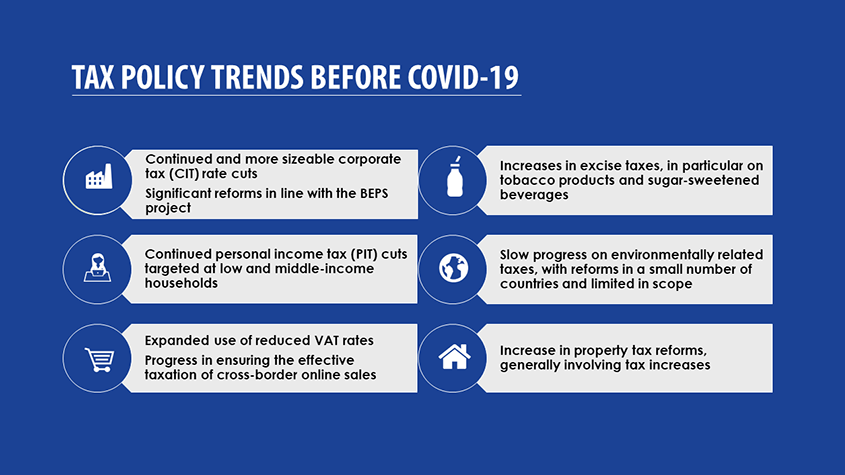

The Tax Policy Reforms publication provides comparative information on tax reforms across countries and tracks tax policy developments over time in OECD countries, as well as in Argentina, Indonesia and South Africa.

2023

Read...

2022

Read...

2021

Read...

2020

Read...

2019

Read...

2018

Read...

2017

Read...

2016

Read...

Provide tailored country-specific tax policy advice

The Country Tax Policy Unit of the OECD Centre for Tax Policy and Administration provides tailored tax policy advice on a series of specific tax topics that can support developing countries with their efforts to mobilise domestic revenues. Find out more.

OECD Tax Policy Reviews provide tailored tax policy recommendations based on an in-depth analysis of countries’ tax systems using reliable comparative data, tax modelling tools, country benchmarking, and international good practices. Find out more.

Africa

Cameroun

Mobilisation des recettes fiscales

pour le financement de la santé

Read...

Tunisia

Tax Policy & Informality

2021

Côte d'Ivoire

Mobilising tax revenues

to finance the health system

Read...

Morocco

Mobilising tax revenues

to finance the health system

Read...

Seychelles

Tax Policy Review

2020

Read...

Morocco

Tax Policy Review

Senegal

Chapter in the

Multidimensional Country Review

2017

Read...

Côte d'Ivoire

Chapter in the

Multidimensional Country Review

2016

Read...

Asia

Kazakhstan

Tax Policy Review

September 2020

Read...

India

OECD Economics Department

Working Paper

2017

Read...

People's Republic of China

OECD Taxation

Working Paper

2013

Read...

Europe

Lithuania

Tax Policy Reviews

2022

Read...

South East Europe

Chapter in Competitiveness in

South East Europe,

A Policy Outlook

Read...

Croatia

Chapter in OECD Reviews of

Regulatory Reform

2019

Read...

Slovenia

Tax Policy Review

2018

Read...

South East Europe

Chapter in Competitiveness in

South East Europe,

A Policy Outlook

2018

Read...

Slovak Republic

OECD Taxation

Working Paper

2015

Read...

Latin America

Colombia

2022

Read...

Chile

Tax Policy Review

2020

Read...

Costa Rica

Tax Policy Review

2017

Read...

Colombia

OECD Economics Department

Working Paper

2015

Read...

Colombia

OECD Economics Department

Working Paper

2015

Read...

Support dialogue and the exchange of good tax policy practices

![]()

Workshops

- Country-specific tax policy workshops to assess and discuss domestic tax reform options, and promote multi-stakeholder dialogue

- Regional and international tax policy workshops to promote capacity building through peer learning

![]()

Training

- Tax policy analysis

- Effective tax rate modelling

- Microsimulation analysis

- Assessment and design of tax incentives

- Domestic resource mobilisation for development

![]()

Conferences

Contact the OECD Country Tax Policy Team

By email: ctp.contact@oecd.org

On Twitter: @OECDtax