Tax

Double blow for workers as inflation drives real wages down and labour taxes up

25/04/2023 - Taxes on labour increased in 2022 as rising nominal wages pushed workers into higher tax brackets and reduced their eligibility for tax credits and cash benefits, according to a new OECD report.

Taxing Wages 2023 also shows that while nominal wages increased, high inflation across the OECD caused wages to decline in real terms, resulting in a double blow for workers.

With inflation reaching its highest level in over 30 years in 2022, the new OECD analysis shows effective tax rates rose in a majority of OECD countries across a range of income levels and household types, with a significant increase for families with children, particularly at lower income levels.

Different approaches OECD countries take to indexing tax and benefit systems to inflation reveal that 17 OECD countries automatically adjust personal income tax systems in line with inflation, while the remaining 21 do so on a discretionary basis. Social security contributions and cash benefits are automatically adjusted in 21 and 19 countries, respectively. The report highlights that low-income households with children are most vulnerable to increases in their effective tax rates when tax and benefit systems are not fully adjusted for inflation.

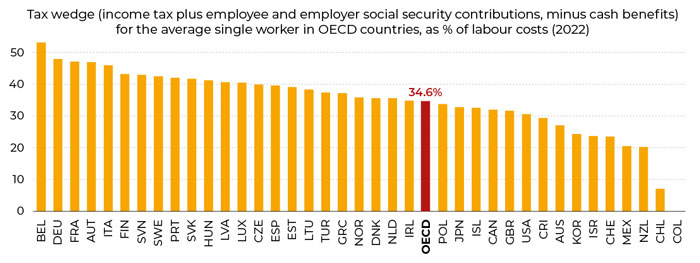

The report focuses on cross-country comparison of the labour tax wedge – defined as total taxes on labour paid by both employees and employers, minus family benefits, as a percentage of labour costs. It looks at eight different household types, varying by income level and household composition. For a single worker earning the average wage, the tax wedge ranged from 53% in Belgium to 0% in Colombia in 2022, averaging 34.6% across the OECD as a whole.

On average across the OECD, the tax wedge for a single parent earning 67% of the average wage increased by 1.6 percentage points between 2021 and 2022 to 16.6%, the largest annual increase in the average tax wedge since 2000 for any of the eight household types covered by the report. For a one-earner couple earning the average wage with two children, the average tax wedge of 25.6% in 2022 reflected an increase of 1.1 percentage points from the previous year – the largest rise for this household type since 2000.

Taxing Wages 2023 enables cross-country comparisons of labour costs and the overall tax and benefit position across the OECD. It analyses income tax paid by employees, cash benefits received by in-work families and the associated social security contributions and payroll taxes made by employees and employers, which are key factors when individuals consider their employment options and businesses make hiring decisions.

Further information and individual country notes are available at: https://oe.cd/taxingwages.

Media enquiries should be directed to Kurt van Dender, Acting Head of the OECD’s Tax Policy and Statistics division (+33 1 4524 8866) or to Spencer Wilson (+33 1 4524 8118) in the OECD Media Office (+33 1 4524 9700).

An embeddable data visualisation for this publication is available at: www.compareyourcountry.org/taxing-wages

Please use the ‘+share/embed’ button to customise this tool for your country and language and to generate the embed code for your website.

Working with over 100 countries, the OECD is a global policy forum that promotes policies to preserve individual liberty and improve the economic and social well-being of people around the world.

Related Documents