Tax and crime

About tax and crime

Tax crimes, money laundering and other financial crimes threaten the strategic, political and economic interests of both developed and developing countries. They also undermine citizens’ confidence in their governments’ ability to get taxpayers to pay their taxes and may deprive governments of revenues needed for sustainable development.

The OECD Oslo Dialogue

A whole of government approach to fighting tax crimes and illicit flows

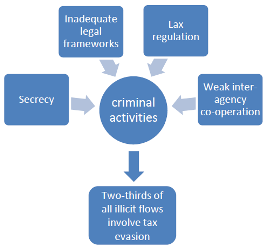

| Criminal activities are dynamic and adapt quickly to take advantage of new opportunities for financial gain, frequently outpacing the legislative changes designed to combat them. Finding better ways to fight financial crime is especially important in times of economic crisis, when the loss of income is all the more damaging to governments, businesses and individuals. |  |

| Countering these activities requires greater transparency, more effective intelligence gathering and analysis, and improvements in co-operation and information sharing between government agencies and between countries to prevent, detect and prosecute criminals and recover the proceeds of their illicit activities. | |

| The OECD Oslo Dialogue, launched by the OECD at the first OECD Forum on Tax and Crime, held in Oslo in March 2011, aims to achieve these objectives. This work is supported by the G20. |

Tackling the professional enablers of tax crimes and other crimes

Over the last decades, the world has witnessed increasingly sophisticated financial crimes being carried out through complex and opaque arrangements, often across borders. These crimes are facilitated by a small subset of professionals, including lawyers, accountants, financial advisers and others who help to engineer the legal and financial structures seen in complex tax evasion and financial crimes. These crimes can have hugely damaging impacts on society, posing systemic risks for the financial system and tax revenue, helping criminals launder the proceeds of crime, and undermining public confidence and trust.

These impacts, like the underlying crimes themselves, do not respect national borders and, indeed, exploit any weaknesses in both domestic and international co-operation. This calls for a multi-disciplinary and multi-agency strategy to ensure effective joining up and co-operation.

A report by the OECD Task Force on Tax Crimes and Other Crimes (TFTC) looks at the approaches and strategies adopted by jurisdictions to disrupt the activities of these professional enablers. The report, Ending the Shell Game: Cracking down on the Professionals who enable Tax and White Collar Crimes, encourages all jurisdictions to consider adopting a national strategy, or to strengthen their existing strategy for addressing professional enablers. The key elements of an effective strategy identified by the TFTC are:

- Skills and awareness: Ensuring that tax crime investigators are equipped with the understanding, intelligence and analytics skills.

- Effective legislation: Ensuring the law provides investigators and prosecutors with sufficient authority to identify, prosecute and sanction professional enablers.

- Disruption strategies: Leveraging the role of professional bodies to prevent abusive behaviour, incentivising early disclosure and whistle-blowing and taking a strong approach to enforcement.

- Co-operation: Ensuring that relevant authorities are proactively maximising the availability of information, intelligence and investigatory powers held by other domestic and international agencies.

- Effective implementation: Appointing a lead person and/or agency with responsibility for overseeing the implementation of the professional enablers strategy.

Tax crime and money laundering

There are substantial similarities between the techniques used to launder the proceeds of crimes and to commit tax crimes. In May 1998 the G7 Finance Ministers encouraged international action to enhance the capacity of anti-money laundering systems to deal effectively with tax related crimes. The G7 considered that international action in this area would strengthen existing anti-money laundering systems and increase the effectiveness of tax information exchange arrangements.

In this regard the OECD's Committee on Fiscal Affairs has established a dialogue with the Financial Action Task Force (FATF) and continues to examine ways of improving co-operation between tax and anti-money laundering authorities. Joint workshops with tax and anti-money laundering officials have been held allowing experts to share experiences on some of the practices that are common to both tax evasion and money laundering. OECD work on tax crime and money laundering is designed to complement that carried out by FATF.

In 2010 the OECD adopted a new OECD Recommendation to facilitate co-operation between tax and other law enforcement authorities to combat serious crimes. In 2012 the FATF revised its recommendations to include tax crimes in the list of predicate offenses to money laundering.

Money Laundering and Terrorist Financing Awareness Handbook for Tax Examiners and Tax Auditors

First launched in 2009 as a practical tool to assist tax authorities in identifying money laundering during the course of normal tax audits, the updated Money Laundering and Terrorist Financing Awareness Handbook for Tax Examiners and Tax Auditors published in June 2019 includes updated money laundering indicators and new material to increase detection and reporting of terrorist financing.

The Ten Global Principles

At the Forum on Tax and Crime in London in 2017, countries agreed that they must possess of all the key building blocks which are needed to effectively fight tax crimes, including the legal, strategic, organisational, and operational measures. Released in 2017, the first edition of Fighting Tax Crime – The Ten Global Principles is a global reference guide setting out the ten core elements for jurisdictions to be able to effectively tackle tax crime. The report therefore provides countries with clear benchmarks, and highlights best practices from around the world. In 2021, the OECD released the second edition of Fighting Tax Crime – The Ten Global Principles which addresses new challenges, such as tackling the small group of professionals who enable tax and other white-collar crimes, and shares best practices in international co-operation in the fight against tax crimes.

Tax Crime Investigation Maturity Model

A self-assessment diagnostic tool, Tax Crime Investigation Maturity Model (Maturity Model) has been developed by the OECD and published in November 2020. The Maturity Model aims to help jurisdictions understand where they stand in the implementation of the OECD's Fighting Tax Crime: The Ten Global Principles, based on a set of empirically observed indicators. By setting out indicators for each increasing level of maturity, the model also charts out an evolutionary path for future progress towards the most cutting-edge practices in tax crime investigation across four levels of maturity: Emerging, Progressing, Established and Aspirational. Thus, the model has relevance for jurisdictions at all stages of development. It also serves as an important tool for measuring the impact of tax crime capacity building interventions, including those promoted by the Addis Tax Initiative and G7 Bari Declaration.

Tax and corruption

Corruption threatens good governance, sustainable development, democratic process, and fair business practices. The OECD is a global leader in the fight against corruption via the Anti-Bribery Convention, taxation, governance, export credits and development aid.

The first milestone in the OECD effort against international bribery was the 1994 Recommendation for countries to take effective measures to deter, prevent and combat the bribery of foreign public officials in connection with international business transactions.

In 1996, the Council recommended that member countries that allow the tax deductibility of bribes to foreign public officials re-examine this treatment with a view to denying the tax deductibility of such bribes. This Council recommendation has met with particular success as Parties to the OECD Anti-Bribery Convention now prohibit generally the deductibility of bribes to foreign public officials. In many cases, countries have gone one step further and have prohibited the deductibility of all bribes.

The broad implementation of this recommendation has sent clear messages to the business community: bribery will no longer be treated as an ordinary or necessary business expense and bribery of foreign public officials is a criminal offence subject to serious penalties.

In 2009, the OECD has adopted a new Recommendation on Tax Measures for Combating Bribery of Foreign Public Officials in International Business Transactions to further strengthen the role of tax authorities in the combat against bribery.

Also to ensure effective detection of bribery, the OECD issued a Bribery Awareness Handbook for Tax Examiners, updated in 2009, which is available in 18 languages. The handbook helps tax authorities identify suspicious payments likely to be bribes so that the denial of deductibility can be enforced and so that bribe payments can be detected and reported to law enforcement authorities. It also serves as a guide for countries wishing to develop internal guidelines on bribery awareness.

Further INFORMATION

- View our publications and reports on tax and crime

- Contact us via e-mail: OECD.TaxandCrime@oecd.org

- Follow us on Twitter: @OECDtax

Related Documents