COVID-19 threatens to undo progress made in closing the gender gap in entrepreneurship

March 2021 - The COVID-19 pandemic is having a profound shock on economies and labour markets around the world, and the impact of this crisis on women is stark. Women make up nearly 70% of the health workers on the frontlines against COVID-19, exposing them to a greater risk of infection. They also continue to do to up to ten times the amount of unpaid care work in households that men do, and face higher risks of economic insecurity.

Even before the COVID-19 pandemic, women were less active in entrepreneurship and the COVID-19 pandemic will likely exacerbate the gender gap in entrepreneurship. There is plenty of evidence to show that female entrepreneurs have been impacted disproportionately by the COVID-19 pandemic. In Germany, for example, female entrepreneurs were more likely to experience an income loss of at least 35% than males between April and July 2020 (Graeber et al., 2020) and female entrepreneurs in Canada reported a 43.5% reduction in hours worked between February and May 2020 relative to 27.3% for male entrepreneurs (Beland et al., 2020).

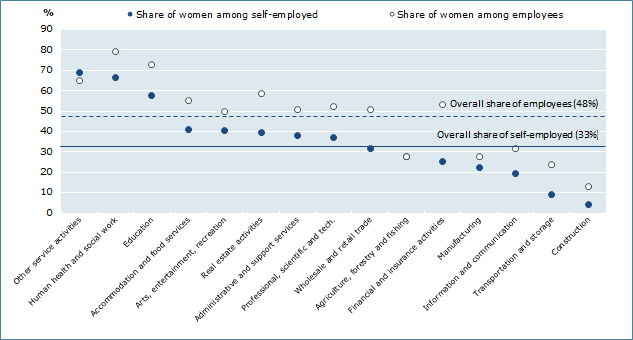

These effects can be explained by several factors. Female entrepreneurs are more likely to work in hard-hit sectors (e.g. personal services, tourism, retail, arts and entertainment) (Figure 1) and are, on average, less financially resilient and less equipped to pivot their business activities in response to the crisis. For example, female entrepreneurs tend to have less access to external advice and are less likely to be operating online (European Commission, 2016). Finally, they have borne a disproportionate share of care responsibilities in households, which restricts the time available for their business.

The large-scale COVID-19 liquidity support measures that governments have introduced have been implemented very quickly but have generally not been gender-sensitive in design. Governments had to act fast to support small business and the self-employed with major liquidity support tools (e.g. loans and wage subsidies to all businesses). However, these have generally been undifferentiated tools that follow a “one-size fits all approach” and the support has not filtered equally to all small businesses. It appears that female entrepreneurs have not benefited as much as male entrepreneurs because they are smaller on average (i.e. some supports have size thresholds) and are less likely on average to use bank loans (i.e. some programmes rely on existing bank products). Gender differences in financial literacy also play a role.

Figure 1. Women are over-represented in the hardest hit sectors

Share of self-employed and employees in France, Germany, Italy, Netherlands, Poland, Spain and United Kingdom, 2019

Source: Eurostat (2020), Labour Force Survey, https://ec.europa.eu/eurostat/web/lfs/data/database.

Further reading

- Beland, L. P., O. Fakorede and D. Mikola (2020), “Short-Term Effect of COVID-19 on Self-Employed Workers in Canada”, Canadian Public Policy, 46(S1), pp. S66-S81.

- Graeber, D., A. Kritikos and J. Seebauer (2020), “COVID-19: A crisis of the female self-employed”, SOEP papers on Multidisciplinary Panel Data Research, No. 1108, Deutsches Institut für Wirtschaftsforschung (DIW), Berlin.

- European Commission (2016), Women in the Digital Age

- OECD (2020), “Women enterprise policy and COVID-19: Towards a gender sensitive response”, summary of proceedings (PDF).

- OECD/European Union (2019), The Missing Entrepreneurs 2019: Policies for Inclusive Entrepreneurship, OECD Publishing, Paris.

Related Documents