Productivité et croissance à long terme

Going for Growth 2016: Mexico

Main Going for Growth page

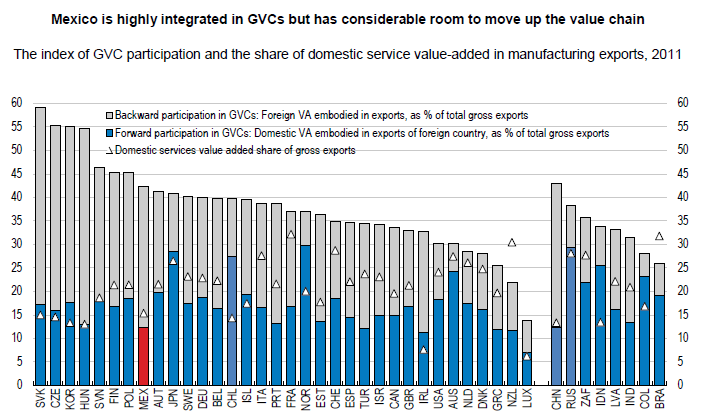

Following several years of modest growth, Mexico needs to adapt to new sources of growth to continue catching up with advanced economies. As the productivity gap with advanced OECD countries remains large, Mexico needs to step-up investment in knowledge-based capital, improve resource allocation and encourage a more widespread development of skills and human capital. This would help notably to further increase the value-added that Mexican firms draw from their relatively high integration in global value chains (GVCs) as assemblers of final products.

Following several years of modest growth, Mexico needs to adapt to new sources of growth to continue catching up with advanced economies. As the productivity gap with advanced OECD countries remains large, Mexico needs to step-up investment in knowledge-based capital, improve resource allocation and encourage a more widespread development of skills and human capital. This would help notably to further increase the value-added that Mexican firms draw from their relatively high integration in global value chains (GVCs) as assemblers of final products.

Note: The index of GVC participation consists of Backward participation, which is the share of foreign value-added embodied in a country’s exports, and Forward participation, which is a country’s value-added embodied in other countries’ exports, as the share of its exports. The backward participation tends to be higher for small countries or those engaging heavily in assembly of final goods (ex: China, Mexico and some central European countries). The Forward participation tends to be higher for countries exporting natural resource and base material (ex: Norway or Australia) and those participating in GVC as providers of core components (ex: USA or Japan).

Source: OECD-WTO Trade in Value Added Database (TiVA), October 2015.

|

Previous Going for Growth recommendations include:

|

|

|

Recent policy actions in these areas include:

The report also discusses the possible impact of structural reforms on other policy objectives (fiscal consolidation, narrowing current account imbalances and reducing income inequality). In the case of Mexico, improving educational achievement would foster human capital accumulation and reduce the degree of earnings inequality. |

Click cover to READ |

Documents connexes

- Economics Department