Productivité et croissance à long terme

Going for Growth 2016: Germany

Main Going for Growth page

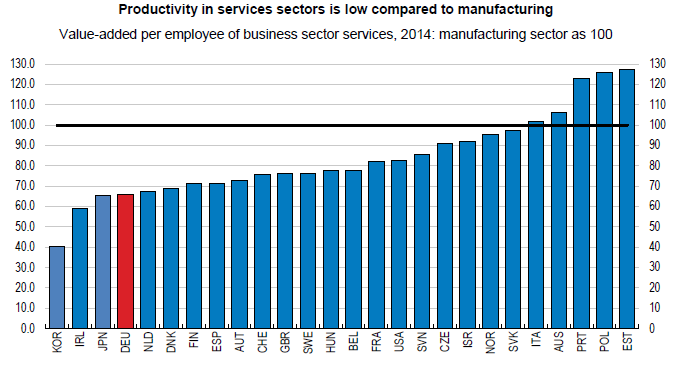

Germany has a productivity level in services that is low relative to the level in manufacturing, with the productivity gap being particularly large compared to other countries. Reducing regulatory barriers to competition and innovation in network industries as well as professional services and crafts remains a key priority. Raising the wellbeing of parents with young children is also high on the policy agenda. This requires comprehensive reforms that in addition to removing institutional and fiscal disincentives for full-time participation would also promote a working environment that can best help to reconcile work and family responsibilities. These measures could also contribute to mitigate the impact of population ageing on the labour force.

Germany has a productivity level in services that is low relative to the level in manufacturing, with the productivity gap being particularly large compared to other countries. Reducing regulatory barriers to competition and innovation in network industries as well as professional services and crafts remains a key priority. Raising the wellbeing of parents with young children is also high on the policy agenda. This requires comprehensive reforms that in addition to removing institutional and fiscal disincentives for full-time participation would also promote a working environment that can best help to reconcile work and family responsibilities. These measures could also contribute to mitigate the impact of population ageing on the labour force.

Note: Business sector services cover distributive trade, repair, accommodation, food and transport services; information and communication; financial and insurance; professional, scientific and support activities. Data refer to 2013 for Belgium, Denmark, France, Israel, Italy, Japan, Korea, Poland, Portugal, Slovak Republic, Spain, Switzerland, the United States; 2012 for Australia and the United Kingdom. The observation on business sector services in Japan is an estimate based on National Accounts for 2013 and the 2014 JIP Database. The data on manufacturing sector for Israel include mining and quarrying while the data on business sector service include real estate activity.

Source: OECD National Accounts Database, Cabinet Office (Japan) 2013 National Accounts, Central Bureau of Statistics (Israel) "Product, Productivity, Compensation of Employed Persons and Capital Return 2005-2013".

|

Previous Going for Growth recommendations include:

|

|

|

Recent policy actions in these areas include:

The report also discusses the possible impact of structural reforms on other policy objectives (fiscal consolidation, narrowing current account imbalances and reducing income inequality). In the case of Germany, enhancing equity in education would help reduce income inequality. Likewise, reforms to encourage full-time labour force participation of women, would make growth more inclusive. |

Click cover to READ |

Documents connexes

- Economics Department