Main Going for Growth page

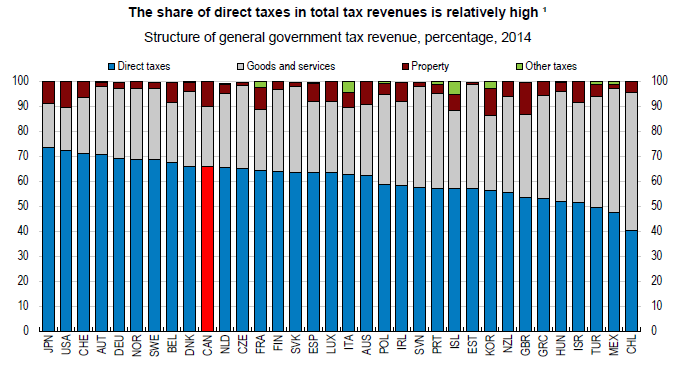

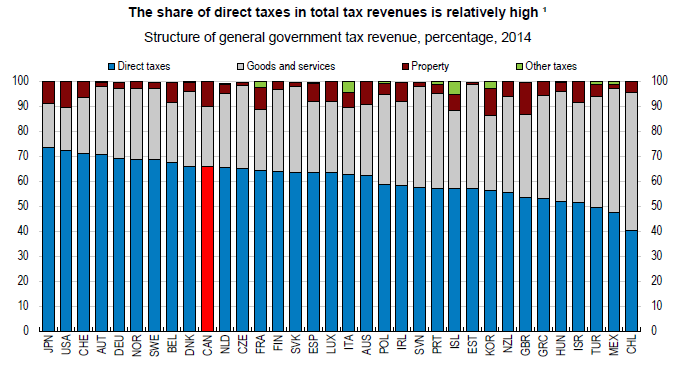

Canada weathered the economic and financial crisis and its aftermath better than most other advanced economies, but productivity growth, in particular growth in multifactor productivity, has been persistently weak despite comparatively high investment in knowledge-based capital and a business environment generally favourable to entrepreneurship. Boosting productivity requires that a number of structural weaknesses be addressed, in the areas of competition, innovation, education and taxation, where a shift in tax revenues towards indirect sources would help to raise economic efficiency.

Canada weathered the economic and financial crisis and its aftermath better than most other advanced economies, but productivity growth, in particular growth in multifactor productivity, has been persistently weak despite comparatively high investment in knowledge-based capital and a business environment generally favourable to entrepreneurship. Boosting productivity requires that a number of structural weaknesses be addressed, in the areas of competition, innovation, education and taxation, where a shift in tax revenues towards indirect sources would help to raise economic efficiency.

1. Direct taxes refer to an aggregate of taxes on income, profits and capital gains, social security contributions and taxes on payroll and workforce. The last available year is 2013 for Australia, Japan, Mexico, the Netherlands and Poland.

Source: OECD, Revenue Statistics Database.

|

Previous Going for Growth recommendations include:

- Reducing barriers to entry and enhancing competition in network and services sectors by moving towards more integrated and competitive electricity markets, privatising Canada Post and eliminating its legally protected monopoly, easing entry regulations in professional services and licensing requirements in retail trade, and eliminating retail price controls.

- Reducing barriers to foreign direct investment by lifting FDI restrictions in key sectors, such as telecommunications, airlines and broadcasting, by reducing the administrative burden of environmental regulation and discrimination against foreign suppliers in professional services, air and road transport.

- Reforming the tax system by increasing environmental and value-added taxes and reducing regressive and distortive income-tax expenditures to further lower statutory corporate and/or personal income tax rates.

- Enhancing access and efficiency in tertiary education by complementing income-contingent loans with needs-based grants to improve access for students from disadvantaged backgrounds, promoting education quality and efficiency by encouraging institutions to specialise in areas where they have a comparative advantage.

- Improving R&D support policies, by lowering the refundable small-firm Scientific Research and Experimental Development (SR&ED) rate towards the large firm rate and using the savings in part to raise grants while allocating them competitively.

|

Sign up to our Blog

|

|

Recent policy actions in these areas include:

- The province of Ontario plans to introduce an emissions trading scheme to be compatible with Quebec and California under the Western Climate Initiative. Alberta is also planning on broadening its carbon tax economy wide.

The report also discusses the possible impact of structural reforms on other policy objectives (fiscal consolidation, narrowing current account imbalances and reducing income inequality). In the case of Canada, improving access to tertiary education for socially disadvantaged students could reduce income inequality while boosting productivity.

|

Click cover to READ

|

Also AvailableEgalement disponible(s)

Canada weathered the economic and financial crisis and its aftermath better than most other advanced economies, but productivity growth, in particular growth in multifactor productivity, has been persistently weak despite comparatively high investment in knowledge-based capital and a business environment generally favourable to entrepreneurship. Boosting productivity requires that a number of structural weaknesses be addressed, in the areas of competition, innovation, education and taxation, where a shift in tax revenues towards indirect sources would help to raise economic efficiency.

Canada weathered the economic and financial crisis and its aftermath better than most other advanced economies, but productivity growth, in particular growth in multifactor productivity, has been persistently weak despite comparatively high investment in knowledge-based capital and a business environment generally favourable to entrepreneurship. Boosting productivity requires that a number of structural weaknesses be addressed, in the areas of competition, innovation, education and taxation, where a shift in tax revenues towards indirect sources would help to raise economic efficiency.