Development Centre

Online Stocktake of Company Reporting Requirements in Key Trading Hubs

Online Stocktake of Company Reporting Requirements in Key Trading Hubs

Why an online Stocktake of company reporting requirements in key trading hubs?

This online Stocktake of company reporting requirements in key trading hubs is intended to take stock of current transparency, reporting and anti-corruption requirements across key global trading hubs. The main purpose of this exercise is to determine whether payments to governments for the purchase of publicly-owned commodities are subject to transparency requirements or reporting obligations in any of the key global trading hubs.

Given the shifting trade flows from West to East, it is important to ensure that increased competition among trading hubs does not come at the expense of integrity. Improving mutual understanding around existing transparency, reporting and anti-corruption requirements applicable in those jurisdictions can help identify gaps that need to be filled to reduce corruption risks and promote improved accountability in commodity trading.

As a significant share of global commodity trading transactions take place in several key global trading hubs. A report by the Swiss Federal Government in 2013 estimated that 70% of the global trade in metals took place in three trading hubs (London, Singapore and Switzerland), and 95% of the global trade in crude oil took place in four trading hubs (London, New York, Singapore and Switzerland).

Consequently, there is an opportunity for these key trading hubs to show leadership in advancing the transparency and accountability agenda in extractives, by tackling the huge and largely overlooked corruption risks associated with the sheer magnitude of volumes and payments involved in commodity trading.

Learn more about OECD work on commodity trading

What does this online Stocktake cover?

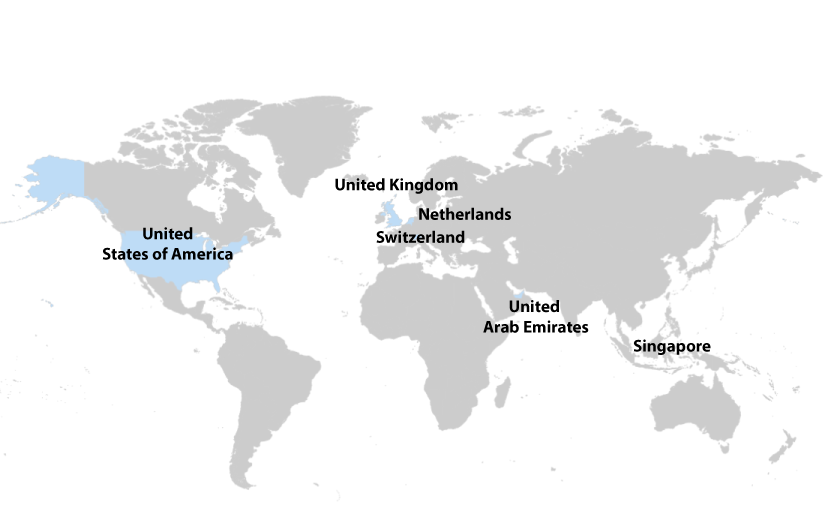

This Stocktake provides an overview of the reporting requirements applicable to companies purchasing oil, gas and minerals from governments in the Netherlands, Singapore, Switzerland, the United Arab Emirates, the United Kingdom and the United States. The Stocktake covers specific regulations that apply to commodity sales by companies’ carrying out business in those trading hubs, any relevant reporting requirements set out in general corporate law that may cover commodity trading related disclosures, and specific anti-corruption requirements that apply to commodity trading transactions in those key trading hubs. The Stocktake also lists the key government regulatory agencies that currently play a role in overseeing aspects of commodity trading in those jurisdictions.

For the purpose of this Stocktake, “commodity trading” is understood as the sale of the government’s share of oil, gas and minerals or other revenue received in-kind by the government, state-owned enterprises or any other entity operating on behalf of the state, including trading-arm subsidiaries, state-owned refineries or private companies selling resources on behalf of the state, as opposed to transactions between private companies. The Stocktake is focused on the physical trade and associated financial flows, as opposed to financial market transactions (e.g. futures), and the Stocktake is specifically focused on the ‘first trade’ transactions, i.e. the sale by governments or state owned enterprises of the state’s share of production. Any reference to “commodities” is in respect of the trade of oil, gas, and minerals, as opposed to agricultural or other commodities.

Is transparency of payments to governments for the purchase of publicly-owned commodities a requirement in any of the trading hubs?

This Stocktake demonstrates that despite the existence of several legislative instruments and regulations that set out limited reporting requirements applicable to commodity trading transactions, there are currently no requirements in these key trading hubs for disclosing payments made by companies to governments when purchasing publicly owned oil, gas and minerals.

This is a significant transparency gap in the international architecture of the governance of commodity trading transactions, and this lack of transparency can give rise to specific and heightened risks of corruption. The OECD Development Centre has identified and mapped corruption risks of cross-cutting relevance for the sales of oil, gas and minerals that can arise at several points in commodity trading transactions (Typology of Corruption Risks in Commodity Trading Transactions), as well as setting out options that trading hubs, home governments, host governments and their state-owned enterprises (SOEs), free zones, commodity exchanges and industry associations can take to operationalise enhanced transparency and reporting requirements for the payments to governments for the purchase of publicly-owned commodities (Options for Operationalising Transparency in Commodity Trading Transactions).

Project background

This Stocktake is an output of the Thematic Dialogue on Commodity Trading Transparency – a multi-stakeholder dialogue platform hosted by the OECD Development Centre. The Thematic Dialogue was launched in response to the call received from the 2016 London Anti-Corruption Summit and the high-level mandate received from the OECD Development Centre’s Governing Board on 3 October 2017, to provide a platform for collaboration on how the global and multifaceted challenges of corruption in commodity trading can be addressed from both the supply and demand side. The outputs of the Thematic Dialogue provide complementary and mutually supportive tools that home countries, trading hubs, trading companies and producing countries, including state-owned enterprises, can use to reduce drivers of corruption, increase transparency and achieve improved accountability in commodity trading.

Key Conclusions

Reporting requirements

The Stocktake has demonstrated that there are currently no specific requirements in the Netherlands, Singapore, Switzerland, the United Arab Emirates, the United Kingdom and the United States for disclosing payments made by companies to governments for the purchase of publicly owned oil, gas and minerals. Some trading hubs do have regulations targeting specific minerals for specific purposes – such as gas (security of supply and combating insider trading and market manipulation), and tin, tantalum, tungsten and gold (to address conflict financing).

All trading hubs covered in this Stocktake have general reporting requirements set out in their corporate law but these provisions do not extend to payments to governments for the purchase of publicly owned oil, gas and minerals.

Lastly, all trading hubs have anti-corruption legislation in place to prevent the bribery of foreign public officials, and these legislative instruments would apply to transactions between commodity trading companies based in these trading hubs and SOEs.

|

Netherlands |

Singapore |

Switzerland |

United Arab Emirates |

United Kingdom |

United States |

|

|

Specific regulations applicable to commodity trading transactions |

REMIT covers importation of gas into the EU Regulation (EU) 2017/821 covers importation of conflict minerals from conflict-affected and high-risk areas |

None identified. |

None identified. |

DMCC Rules for Risk Based Due Diligence in the Gold and Precious Metals Supply Chain may cover some “first trade” purchases of publicly-owned minerals |

Gas Act 1986 & Electricity and Gas (Market Integrity and Transparency) Regulations 2013 set out rules for gas importation and transportation |

Dodd-Frank Act covers importation of conflict minerals from conflict-affected and high-risk areas |

|

General corporate law provisions for reporting purchases of publicly-owned oil, gas and minerals |

None identified |

None identified |

None identified |

None identified |

None identified |

None identified |

|

Anti-corruption requirements |

Dutch Criminal Code criminalises foreign bribery |

Prevention of Corruption Act criminalises foreign bribery |

Swiss Criminal Code criminalises foreign bribery |

Federal Law No. 3 of 1987 criminalises foreign bribery | Bribery Act 2010 criminalises foreign bribery | Foreign Corrupt Practices Act 1977 criminalises foreign bribery |

Corporate structure of commodity trading companies

The Stocktake shows that many companies involved in commodity trading have a presence across multiple hubs, and several of these companies have offices in each of the hubs covered under this Stocktake. Many are large independent trading companies (e.g. Glencore, Trafigura), but also international oil companies (e.g. ExxonMobil, Total), international mining companies (e.g. BHP Billiton, Rio Tinto), and SOEs themselves (e.g. Petrobras, PetroChina).

Recent research commissioned by the OECD Development Co-operation Directorate demonstrated that companies involved in commodity trading are both public and private, and form part of a wider corporate structure with multiple entities with holdings and subsidiaries registered in different jurisdictions – including trading hubs and offshore financial centres.

|

Netherlands |

Singapore |

Switzerland |

United Arab Emirates |

United Kingdom |

United States |

|

|

Independent commodity trading companies |

Argos Energies, , Koch Industries, , Noble, SHV Holdings, Tamoil, , l | Arkore, Hin Leong Trading (under bankruptcy proceedings), , , , Philia SA, SG Global Commodity Pte. Ltd, , Uniper, Vale, , | Archer Daniels Midland, Augusta Energy SA, COFCO Resources SA, Cutrale Trading SA, Gerald , IMR Metallurgical Resources AG, Indagro, , LH Trading, Lukoil , MMK Steel Trade AG, Philia SA, Sahara Energy Services Sàrl, Saras Trading SA, Telf AG, | Arabian Commodities FZE, Commodities Trading Company LLC, , Philia SA, Star Global, SBC Trading Group, Wonder Star Trading LLC, | Marubeni, Petroineos SUMITOMO, | , Marubeni, Petroineos, SUMITOMO |

|

International oil companies, mining companies & other industry |

, | ArcelorMittal, Anglo American, , , Chevron, Conoco Phillips, EDF, Enel, Engie, ENI, , Mabanaft, Marathon Petroleum, Phillips 66, Reliance Industries, , RWE, Rusal, REPSOL, Rio Tinto, Total | , , Litasco SA, Trading Switzerland AG, Total | Litasco, OMV Group, , SIMEC Group Limited | Anglo American, AngloGold Ashanti, , , Centrica, Chevron, Conoco Phillips, EDF, ENI, Lukoil, Mitsubishi, Mitsui, Phillips 66, RWE, Rio Tinto, , Valero Energy | AngloGold Ashanti, ArcelorMittal, , Centrica, Chevron, Conoco Phillips, EDF, Enel, Engie, ENI, , Iberdrola, Lukoil, Mabanaft, Marathon Petroleum, Mitsubishi, Mitsui, Phillips 66, REPSOL, Rio Tinto, RWE, , Total, United States Steel Corporation, Valero Energy |

|

State-owned Enterprises |

KazMunayGas, Socar Trading | , PetroChina, Rosneft | Switzerland AG, KazMunayGas Trading SA, Socar Trading SA | , KazMunayGas, PetroChina, Socar Trading | Petronas, , PetroChina, Saudi Aramco | PEMEX, PetroChina |

Online Stocktake of Company Reporting Requirements

in Key Trading Hubs

1. THE NETHERLANDS

1.1 Overview of trading hub

In 2019, The Netherlands was the seventeenth largest economy in the world in terms of GDP, the seventh largest economy in terms of total exports and the seventh largest economy in terms of total imports (Observatory of Economic Complexity (OEC), an analytical tool for understanding the dynamics of economic development).

The port of Rotterdam is a major hub for the storage, refining and worldwide distribution of crude oil. The port of Amsterdam is the world’s largest port for gasoline, as well as a major hub for kerosene and diesel.

There is a strong presence of the world’s largest commodity traders in the Netherlands, which include not only the port-based physical operational functions but also the trading desks, treasuries and holding companies. Major companies involved in commodity trading that are headquartered in the Netherlands include: Argos Energies, Louis Dreyfus, Royal Dutch Shell, SHV Holdings and Tamoil.

Major companies with a trading desk or other significant presence in the Netherlands include: Equinor, Gazprom, Glencore, Gunvor, KazMunayGas, Koch Industries, Lukoil, Mercuria, Noble, Socar Trading, Trafigura and Vitol.

The presence of these companies is supported by an active financial sector that underpins the majority of commodity trading transactions, and includes leading Dutch banks, such as ABN-Amro Bank, Amsterdam Trade Bank, ING, Rabobank.

1.2 Relevant regulatory agencies

Authority for Consumers and Markets (Autoriteit Consument Markt) and Agency for the Cooperation of Energy Regulators

The Authority for Consumers and Markets (ACA) is a Dutch regulatory authority and the Agency for the Cooperation of Energy Regulators (ACER) is an agency of the European Union. Both regulatory agencies are tasked with the implementation of Regulation (EU) No. 1227/2011, and consequently, these agencies have visibility over contracts for the importation of gas into the EU (whether by pipeline or by ship).

Ministry of Economic Affairs and Climate Policy

The Ministry of Economic Affairs and Climate Policy is the Dutch Ministry responsible for policy development in areas that may affect commodity traders, including: commercial policy, international trade, industrial policy, investment policy, energy policy, natural resources, and mining.

National Office for Serious Fraud (Functioneel Parket)

The National Office for Serious Fraud is charged with prosecuting offences that are being investigated by special investigative agencies, including foreign bribery.

1.3 Regulatory framework

1.3.1 Specific regulations applicable to commodity trading transactions

Regulation (EU) No. 1227/2011

In October 2011, the European Parliament and the European Council adopted Regulation (EU) No. 1227/2011, Regulation on Wholesale Energy Market Integrity and Transparency (REMIT) in order to increase the transparency and stability of the European energy markets while combating insider trading and market manipulation, and creating a level-playing field for all market participants.

The provisions of REMIT apply to all market participants, which include energy trading companies, producers of electricity or natural gas (including producers supplying production to their in-house trading unit or energy trading company), shippers and transmission systems operators, and other entities.

Consequently, any company located in the Netherlands that is importing gas into the EU, must register its relevant contracts for import of gas on the EU-wide REMIT database. Furthermore, all companies that intend to enter into transactions covered under REMIT are required to first register with their relevant national regulatory authority. For companies based in the Netherlands, the relevant national regulatory authority refers to ACA.

Market participants are required to report details of their transactions to the Agency for the Cooperation of Energy Regulators (ACER). ACER is mandated to collect and screen wholesale trading transaction data across the EU, perform an initial assessment of anomalous events, and where required, notify suspicious cases to national regulatory authorities for investigation.

Although individual transaction data is not disclosed publicly, ACER does publish aggregated REMIT information for transparency reasons.

Regulation (EU) 2017/821

On 17 May 2017 the EU adopted regulations laying down supply chain due diligence obligations for EU importers of tin, tantalum and tungsten, their ores, and gold originating from conflict-affected and high-risk areas based on the OECD’s Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas which make reference to payment transparency and EITI.

The provisions of this legislation will apply from 1 January 2021.

Under Article 7 of Regulation (EU) 2017/821, EU companies importing tin, tantalum and tungsten or gold from conflict-affected and high-risk areas must on an annual basis, publicly report as widely as possible, including on the internet, on their supply chain due diligence policies and practices for responsible sourcing. That report shall contain the steps taken by them to implement the obligations as regards their management system under Article 4, and their risk management under Article 5, as well as a summary report of the third-party audits, including the name of the auditor, with due regard for business confidentiality and other competitive concerns.

It is possible that some “first trade” purchases of publicly-owned minerals (tin, tantalum and tungsten or gold) may be caught under the reporting requirements of the Regulation (EU) 2017/821 – although this is not the express purpose of this Regulation.

1.3.2 General corporate law – reporting and transparency obligations applicable to commodity trading transactions

Dutch Civil Code

Dutch corporate law is part of the Dutch Civil Code. The legal provisions relating to companies limited by shares in the Netherlands are included in Book 2 of the DCC, which contains provisions relating to all legal persons and entities, including co-operatives, associations, foundations and limited liability companies.

The legal provisions relating to the preparation, the format and contents, filing and audit requirements for annual reports are set out in Book 2, Part 9 of the DCC. The Code reflects the requirements of the Directive 2013/34/EU.

The annual report will normally comprise three parts:

- the yearly report of the managing board;

- the financial statements, comprising a profit, and

- loss account, balance sheet, notes to the accounts and (only for large and medium-sized companies) cash-flow statement; and

- other information, comprising, inter alia, the auditor’s report and the provisions in the articles of association concerning appropriation of profits.

There is no specific requirement for commodity trading companies to disclose their payments to governments in their annual reports under the DCC.

1.3.3 Anti-corruption requirements for commodity trading transactions

Dutch Criminal Code

Article 177 of the Dutch Criminal Code (DCC) refers to the active bribery of a public official. The DCC prescribes that punishment in the form of a prison sentence will be imposed on whoever makes a gift or a promise to a public official, or offers him a service with a view to getting him to carry out or fail to carry out a service.

The criminal liability of legal persons is set out under article 51 of the DCC. If an offence is committed by a legal person, “criminal proceedings may be instituted and the punishments and other measures provided for by the law may be implemented where appropriate against (a) the legal person, or (b) those who ordered the commission of the offence, and those were in control of such unlawful behaviour, or (c) the persons mentioned under (a) and (b) together.

2. SINGAPORE

2.1 Overview of trading hub

In 2019, Singapore was the 33rd largest economy in the world in terms of GDP, the 18th largest economy in terms of total exports and the 16th largest economy in terms of total imports (Observatory of Economic Complexity (OEC), an analytical tool for understanding the dynamics of economic development).

Singapore has a share of 15% of the global crude oil market, and ranks second after Switzerland for its share in the global metals and minerals market. The commodity trading sector contributes to 4.5% of Singapore’s GDP, generating SGD 20.3 billion in value and employing over 15,000 professionals.

Since the early 2000s, the government of Singapore has undertaken a number of initiatives to attract commodity trading companies. In 2001 Singapore established the Global Traders Programme, offering a 10% corporate tax rate to traders, which lowers to just 5% if the company hires Singaporean workers and uses Singaporean banking and financial services. The Singapore Government also supports the International Trading Institute (ITI), Global Traders Summit and International Trader Development Fund.

Consequently, Singapore has seen significant growth of its global share of commodity trading, driven by commodity specific initiatives (and corresponding tax benefits), its geographic locations (i.e. proximity to physical assets), as well as its internationally recognised legal and regulatory frameworks that offer companies significant protections and flexibility.

Major companies involved in commodity trading that are headquartered in Singapore include: Arkore, Hin Leong Trading (under bankruptcy proceedings), Philia SA, SG Global Commodity Pte. Ltd.

Major companies with a trading desk or other significant presence include in Singapore: Anglo American, ArcelorMittal, Archer Daniels Midland, BHP, BP plc, Cargill, Castleton Commodities, Chevron, Conoco Phillips, EDF, Enel, Engie, ENI, Equinor, Exxon, Gazprom, Glencore, Gunvor, Koch Supply and trading, Louis Dreyfus, Lukoil, Mabanaft, Marathon Petroleum, Mercuria, Petrobras, PetroChina, Phillips 66, Reliance Industries, REPSOL, Rio Tinto, Rosneft, Rusal, RWE, Royal Dutch Shell, Total, Trafigura, Uniper, Vale, Vitol and World Fuel Services.

2.2 Relevant regulatory agencies

Enterprise Singapore

Enterprise Singapore is an umbrella agency of the Ministry of Trade and Industry (MTI) that administers the Commodity Trading Act, which regulates business activities in “commodity contracts” and “spot commodity trading”. Enterprise Singapore promotes international trade and partners – as part of an ongoing effort to make Singapore’s commodities trading environment more conducive for international players.

Singapore Police Force

The Commercial Affairs Department (CAD) of the Singapore Police Force enforces the Commodity Trading Act.

Accounting and Corporate Regulatory Authority

The Accounting and Corporate Regulatory Authority is the national regulator of business entities, public accountants and corporate service providers in Singapore.

Corrupt Practices Investigation Bureau

The Corrupt Practices Investigation Bureau is responsible for investigating and preventing corruption in Singapore, focusing on corruption-related offences arising under the Prevention of Corruption Act and the Penal Code.

2.3 Regulatory framework

2.3.1 Specific regulations applicable to commodity trading transactions

Commodity Trading Act

The Commodity Trading (CTA) regulates commodity trading activities, including commodity forward contracts, leveraged commodity trading, trading in differences and spot commodity trading. Spot commodity trading” is defined in section 2 of the CTA as “…the purchase or sale of a commodity at its current market or spot price, where it is intended that such transaction results in the physical delivery of the commodity”.

The CTA sets out licensing requirements for persons conducting business activities involving “spot commodity trading” under section 13A(1) of the CTA unless specifically exempted under section 14A(1) to the extent specified in the Schedule to the CTA. The licences covering “spot commodity trading” include licences for “spot commodity broker”, “spot commodity broker’s representative”, “spot commodity pool operator” and “spot commodity pool operator’s representative”.

However, there are no specific requirements in the CTA that apply to commodity trading companies located in Singapore that purchase publicly-owned commodities.

2.3.2 General corporate law – reporting and transparency obligations applicable to commodity trading transactions

Companies Act

The Companies Act sets out requirements for companies carrying out business in Singapore. Reporting requirements differ for companies incorporated in Singapore and for foreign companies.

Singapore-incorporated companies

Under the Companies Act, all Singapore-incorporated companies are required to file annual returns with ACRA to ensure that the company’s information on ACRA’s register is up to date. The annual return is an electronic form lodged with ACRA and contains important particulars of the company such as the name of the directors, secretary, its members, and the date to which the financial statements of the company are made up to. The annual return provides critical information that helps the company’s stakeholders to make informed decisions.

All Singapore (SG) incorporated companies are required to file financial statements with ACRA as part of its annual return. Financial statements provide financial information that is comparable and useful to a wide range of users in making economic decisions, including information on the balance sheet, directors, purpose of the company, information from the auditors etc.

Under sections 201(2) and 201(5) of the Companies Act directors are responsible to present financial statements that comply with Accounting Standards issued by the Accounting Standards Council; and give a true and fair view of the financial position and performance of the company.

There are no requirements in the Companies Act for Singaporean incorporated companies to disclose information about purchases of publicly-owned oil, gas or minerals.

Foreign companies

All foreign companies are required to lodge their financial statements as well as those of their Singapore Branches when filing annual returns with the Accounting and Corporate Regulatory Authority.

(a) if a foreign company has prepared financial statements in accordance with International Financial Reporting Standards (IFRS) and/or the accounting standards as required in the law of its country of incorporation / formation, that foreign company can lodge the same set of financial statements in its annual filing without the need to apply to ACRA; and

(b) other foreign companies that had not prepared a set of financial statements in accordance to IFRS or accounting standards as required in the law of its country or incorporation / formation are required to prepare and lodge their financial statements prepared in accordance with the Accounting Standards, unless they have obtained approval from the ACRA under section 373(13) of the Companies Act, for relief from requirements relating to audit or form and content of the financial statements and other documents.

For application under s373(13), the foreign company must provide the following documents during the application:

- Balance sheet and income statement (including the financials of all its branch) ;

- Significant accounting policies (including basis of measurement) prepared in accordance with the accounting standards required in the law of the foreign company’s country of incorporation / formation; and

- Statement by directors in the same format (i.e. whether the financial information is true and fair, whether the foreign company is able to pay its debts as and when it falls due and the list of directors in office at the date of the statement) as those of local Singapore companies.

In addition, all Singapore Branches are required to prepare audited profit and loss account which complies with the Accounting Standards and give a true and fair view of the profit or loss arising out of their operations in Singapore, and audited statement showing their assets used in and liabilities arising out of their operations in Singapore, and lodge these documents with ACRA.

There are no requirements in the Companies Act for foreign companies to disclose information about purchases of publicly-owned oil, gas or minerals.

2.3.3 Anti-corruption requirements applicable to commodity trading transactions

Prevention of Corruption Act

Under section 5 of the Prevention of Corruption Act (PCA), it is an offence for a person (whether by himself or herself, or in conjunction with any other person) to:

- corruptly solicit, receive, or agree to receive for himself, herself or any other person; or

- corruptly give, promise, or offer to any person, whether for the benefit of that person or of another person, any - gratification as an inducement to or reward for, or otherwise on account of:

- any person doing or forbearing to do anything in respect of any matter or transaction whatsoever, actual or proposed; or

- any member, officer or servant of a public body doing or forbearing to do anything in respect of any matter or transaction whatsoever, actual or proposed, in which such public body is concerned.

Under section 37 of the PCA gives the anti-corruption legislation extraterritorial effect, because if the act of bribery takes place outside Singapore and the bribe is carried out by a Singaporean citizen, section 37 of the PCA states that the offender would be dealt with as if the bribe had taken place in Singapore.

Corrupt payments through intermediaries or third parties, whether such payments are made to foreign public officials or to other persons, are prohibited. Section 5 of the PCA expressly provides that a person can commit the offence of bribery either ‘by himself or by or in conjunction with any other person’.

Both individuals and companies can be held liable for bribery offences, including bribery of a foreign official. The various provisions in the PCA and Penal Code set out certain offences that may be committed by a ‘person’ if such person were to engage in certain corrupt behaviour. The term ‘person’ is defined in the Singapore Interpretation Act to include ‘any company or association of body of persons, corporate or unincorporated’.

Consequently, commodity trading companies located in Singapore that are purchasing publicly-owned oil, gas or minerals will be subject to the provisions of the Prevention of Corruption Act. Employees of those companies will be subject to the PCA if they are Singaporean citizens. It is unclear whether non-Singaporean citizens would also be captured here.

3. SWITZERTLAND

3.1 Overview of trading hub

In 2019, Switzerland was the 20th largest economy in the world in terms of GDP, the 17th largest economy in terms of total exports and the 17th largest economy in terms of total imports (Observatory of Economic Complexity (OEC), an analytical tool for understanding the dynamics of economic development).

Commodities trading is of major significance for the Swiss economy. Switzerland is among the largest trading hubs for oil and petroleum, metals, minerals and agricultural products (soft commodities). In 2016, trading volumes of the five largest companies in Switzerland (Vitol, Glencore, Trafigura, Gunvor and Mercuria) amounted to 18 million barrels of crude per day, which accounts for close to 20 per cent of global demand.

According to estimates from 2018, over three billion tons of commodities with a value of close to CHF 960 billion are traded in Switzerland. New statistics from March 2021 by the Federal Statistical Office show that there are some 900 firms in Switzerland engaged in commodities trading, and providing employment for approximately 10,000 people. Almost three-quarters of trading firm jobs (core positions) are located in the cantons of Geneva (44% of the total), Zug (21.4%) and Ticino (9.5%).

Major commodity traders companies headquartered in Switzerland include: Cutrale Trading SA, Glencore, Gunvor, IMR Metallurgical Resources AG, Indagro SA, LH Trading, Louis Dreyfus, Mercuria, MMK Steel Trade AG, Telf AG, Trafigura and Vitol.

Major companies with a trading desk or other significant presence include: Archer Daniels Midland, Augusta Energy SA, Cargill International SA, Castleton Commodities, COFCO Resources SA, ExxonMobil, Gazprom Marketing & Trading Switzerland AG, Gerald Group, KazMunayGas Trading SA, Koch Supply & Trading Sàrl, Lukoil, Philia SA, Sahara Energy Services Sàrl, Litasco SA, Saras Trading SA, Shell Trading Switzerland AG, Socar Trading SA, Total.

3.2 Relevant regulatory agencies

Swiss Financial Market Supervisory Authority

The Swiss Financial Market Supervisory Authority (FINMA) is a financial market regulator in Switzerland, primarily responsible for supervision of financial markets and financial institutions. FINMA was created in 2009 through the amalgamation of previous regulatory agencies, and has jurisdiction over the anti-money laundering ordinances of those disestablished agencies.

State Secretariat for Economic Affairs

The State Secretariat for Economic Affairs (SECO) is the federal government`s agency for all core issues relating to economic and labour market policy, and is responsible for the economy’s competition policy framework conditions, for instance by further developing the Cartel Act and the Internal Market Act, decision-making in the form of analyses of global economic integration and the challenges posed by the digital economy. SECO also supports policies in sectors such as energy, environment, finance, healthcare and infrastructure.

Office of the Attorney General

The Office of the Attorney General (OAG) is the prosecutors’ office for the Swiss Confederation, and is responsible for investigating and prosecuting offences that fall under federal jurisdiction. The OAG takes the lead in handling foreign bribery cases, although individual cantons may also have concurrent jurisdiction under Swiss law.

3.3 Regulatory framework

3.3.1 Specific regulations applicable to commodity trading transactions

No current regulations identified.

However, in June 2020, Switzerland enacted Articles 964a et seq. of the Swiss Code of Obligations requiring Swiss extractive companies to disclose the payments they make to governments for the right to explore for and extract oil, gas and minerals. Article 964f delegates authority to the Federal Council to apply these new transparency provisions to Swiss commodity traders buying oil, gas and minerals, in accordance with an international procedure where other key trading hubs would enact similar provisions.

3.3.2 General corporate law: Reporting and transparency obligations applicable to commodity trading transactions

Swiss Code of Obligations

The Swiss law on accounting and financial reporting is included in the Swiss Code of Obligations. Legal entities (public limited companies, limited partnerships, limited liability companies, cooperatives, associations and foundations are required to prepare annual reports (Article 957-958). Under these provisions, companies are required to produce an ‘annual business report’, which is comprised of:

- Annual financial statements;

- Annual report; and

- Consolidated financial statements (if required by law)

There are no specific requirements in the Swiss Code of Obligations for companies to disclose information about purchases of publicly-owned oil, gas or minerals.

3.3.3. Anti-corruption requirements applicable to commodity trading transactions

Swiss Criminal Code

The bribery of Swiss and foreign public officials as well as private individuals is illegal under Article 322 ter-decies of the Swiss Criminal Code. This covers the liability of both, individuals and legal persons (i.e. companies).

Specifically, Article 322 provides that any person who offers, promises or gives a member of a judicial or other authority, a public official, an officially-appointed expert, translator or interpreter, an arbitrator, or a member of the armed forces who is acting for a foreign state or international organisation an undue advantage, or gives such an advantage to a third party, in order that the person carries out or fails to carry out an act in connection with his official activities which is contrary to his duties or dependent on his discretion, any person who as a member of a judicial or other authority, a public official, an officially-appointed expert, translator or interpreter, an arbitrator, or a member of the armed forces of a foreign state or of an international organisation demands, secures the promise of, or accepts an undue advantage for himself or for a third party in order that he carries out or fails to carry out an act in connection with his official activity which is contrary to his duty or dependent on his discretion is liable to a custodial sentence not exceeding five years or to a monetary penalty.

4. UNITED ARAB EMIRATES

4.1. Overview of Trading Hub

In 2019, the United Arab Emirates (UAE) was the 28th largest economy in the world in terms of GDP, the 24th largest economy in terms of total exports and the 22nd largest economy in terms of total imports (Observatory of Economic Complexity (OEC), an analytical tool for understanding the dynamics of economic development).

The UAE, especially the Emirate of Dubai has capitalised on shifting flows from West to East due to its geographical location – its time zone, proximity to major transportation routes, and proximity to production.

The Dubai Multi Commodities Centre (DMCC) is a free economic zone established in 2002 to provide the physical, market and financial infrastructure required to establish a hub for global commodities trade. The DMCC is responsible for regulating companies licenced in the DMCC free zone. The DMCC also hosts the Dubai Gold and Commodities Exchange (DGCX) and the Dubai Diamond Exchange (DDE).

In 2018, the DMCC recorded over 22 million trade contracts signed in 2018, with a combined value of approximately USD 476 billion. According to DMCC, Dubai now accounts for 25% of the global gold trade. As of 2020, over 18,000 companies are based in the DMCC.

Major commodity traders companies headquartered in the UAE include: Arabian Commodities FZE, Commodities Trading Company LLC, Star Global, SBC Trading Group, Wonder Star Trading LLC.

Major companies with a trading desk or other significant presence include: Gazprom, Glencore, Gunvor, KazMunayGas, Litasco, Mercuria, OMV Group, PetroChina, Philia SA, Royal Dutch Shell, SIMEC Group Limited, Socar Trading, Trafigura, Vitol, World Fuel Services.

4.2 Relevant regulatory agencies

Securities and Commodities Authority

The Securities and Commodities Authority is the governing body for all the stock exchanges, securities and commodities listed in UAE. This includes Abu Dhabi Securities Exchange (ADX), Dubai Financial Market (DFM) and Dubai Gold and Commodities Exchange (DGFX) and securities and commodities listed in these markets.

Ministry of Economy

The Ministry of Economy is responsible for proposing legislation and organisational regulations for commercial and economic activity and supervising the implementation of that legislation and regulations.

Abu Dhabi Department of Economic Development

The Abu Dhabi Department of Economic Development (ADDED) regulates the business sector in the emirate of Abu Dhabi through the establishment of policies, regulations, decisions, and executive and operational circulars regulating the sector, and through licencing entities, companies, and employees working in the economic sector.

Department of Economic Development – Government of Dubai

Department of Economic Development – Government of Dubai is the government body entrusted to set and drive the economic agenda of the emirate of Dubai. DED and its agencies develop economic plans and policies, identify and support the growth of strategic sectors, and provide services to domestic and international investors and businesses.

Dubai Multi Commodities Centre Authority

The Dubai Multi Commodities Centre Authority is a Government of Dubai Authority that performs a range of roles to position Dubai as the preferred destination for global commodities trade. DMCC is the master developer and licensing authority for the Jumeirah Lakes Towers (JLT) Free Zone, one of the largest mixed use free zone developments in Dubai. The DMCC Authority oversees a compliance and regulatory regime which is in line with the compliance related laws and regulations of the UAE Federal Government.

4.3 Regulatory framework

4.3.1 Specific regulations applicable to commodity trading transactions

UAE Federal regulations

No specific regulations identified in respect of requirements for companies to disclose information on purchases of publicly-owned oil, gas or minerals.

DMCC regulations

DMCC Rules for Risk Based Due Diligence in the Gold and Precious Metals Supply Chain

The DMCC Rules for Risk Based Due Diligence in the Gold and Precious Metals Supply Chain (DMCC’s Rules for RBD-GPM) were established by the DMCC Authority to ensure responsible global supply chain management of gold and precious metals, in order to assist companies that are subject to the Dubai Good Delivery standard (DGD) and the Market Deliverable Brand standard. The DMCC’s Rules for RBD-GPM follow the 5-step framework for risk-based due diligence of the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from conflict-affected and high-risk areas.

Under Rule 4.1 of the DMCC’s Rules for RBD-GPM, each company is subject to a review of its compliance with the DMCC Rules by an independent third-party. Under Rule 4.6, each company is required to publish an annual report – which must include a summary of the review.

Annex 4, clause 12.3 sets out the minimum requirements of the review report.

In relation to transactions:

- the total volume of Mined Gold and/or Precious Metals and/or Recycled Gold and/or Precious Metals in relation to the total number of transactions during the period subject to Review;

- the total volumes of cash transactions (if any) and their usage in excess of government thresholds as applicable in the Accredited Member’s place of domicile;

- the total volumes of unrelated third-party payments (i.e. cash, bank transfers and metal accounts held with bullion banks) and physical gold and/or precious metal deliveries in unusual circumstances that are not consistent with local and/or international market practices (for example, value, quantity, quality, profit); and

adequacy and implementation of track and trace mechanisms from mine/supplier to sale and/or physical delivery to the Accredited Member’s suppliers.

In relation to geographical considerations:

- gold and/or precious metal sourced from different geographical locations based on physical form; quantity; actual or declared purity; country of origin and transportation; and

- any transaction which is related to a sanctioned and/or embargoed country, entity, or individual.

Consequently, it is possible that some “first trade” purchases of publicly-owned minerals (gold or precious metals) may be caught under the reporting requirements of the DMCC’s Rules for RBD-GPM – although this is not the purpose of these rules.

4.3.2 General corporate law – reporting and transparency obligations applicable to commodity trading transactions

UAE Federal regulations

UAE Federal Law No. 2 of 2015 on Commercial Companies

This law applies to any economic entity that undertakes any commercial, financial, industrial, agricultural, real estate or other kinds of economic activity on the UAE mainland. Article 87 sets out the responsibility for preparing annual company accounts, the annual budget, the profit and loss account, and an annual report on the affairs and financial position of the company.

There is no specific requirement in the UAE Federal Law No. 2 of 2015 on Commercial Companies to disclose information in annual company accounts in respect of purchases of publicly-owned oil, gas or minerals.

Economic Substance Regulations

Under the Economic Substance Regulations (ESR), certain companies must provide to the National Assessing Authority, an Economic Substance Report setting out information on the Licensee and the income, expenditure, assets, employees and governance related to its relevant activities in the UAE.

There is no requirement in the Economic Substance Regulations to disclose information in respect of purchases of publicly-owned oil, gas or minerals.

DMCC regulations

DMCC Company Regulations

The DMCC Company Regulations set out the rules applicable to companies wishing to conduct business in and from the DMCC. Article 58 provides that the directors of every company shall prepare annual company accounts for each financial year, including a balance sheet and a profit and loss account.

There is no specific requirement in the DMCC Company Regulations to disclose information in annual company accounts in respect of purchases of publicly-owned oil, gas or minerals.

4.3.3 Anti-corruption requirements applicable to commodity trading transactions

UAE Federal regulations

Federal Decree No. 8 of 2006

Pursuant to Federal Decree No. 8 of 2006, the UAE ratified the United Nations Convention against Corruption. The Convention requires each state party to adopt such legislative and other measures as may be necessary to establish as a criminal offence the bribery of foreign officials and officials of public international organisations.

Federal Law No. 3 of 1987 (the Federal Penal Code)

Article 237 of the Federal Law No. 3 of 1987 (the Federal Penal Code) provides that it is an offence for any individual to promise, offer or provide (whether directly or indirectly) to a foreign public servant a gift, benefit or grant that is not owed, whether for the benefit of the employee himself or herself or for another person or entity, in consideration for such employee committing or refraining from committing an act pertaining to the duties of office in breach of the obligations of his office.

The offense under Article 237 applies to both individuals and companies, and also extends to situations where bribes are paid through an intermediary.

5. UNITED KINGDOM

5.1 Overview of trading hub

In 2019, the United Kingdom was the sixth largest economy in the world in terms of GDP, the tenth largest economy in terms of total exports and the fourth largest economy in terms of total imports (Observatory of Economic Complexity (OEC), an analytical tool for understanding the dynamics of economic development).

London is a large global trading hub with a significant share of the global trade of oil, gas and minerals. Estimates from 2013 suggest that London has a share of 25% of the global market for oil and gas, 20% for refined products, and 10% for silver and base metals. London is the second largest market for gold and has significant trade of platinum and cobalt as well.

Two major commodity exchanges are based in London: the London Metal Exchange (LME) and the London Bullion Market, where both physical and derivative commodities are traded.

Major commodity traders companies headquartered in the UK include: Anglo American, AngloGold Ashanti, BHP, BP plc, Centrica, Petroineos, Rio Tinto, Royal Dutch Shell.

Major companies with a trading desk or other significant presence in the UK include: Castleton Commodities, Chevron, Conoco Phillips, EDF, ENI, Equinor, ExxonMobil, Gazprom, Glencore, Gunvor, Koch Supply and Trading, Lukoil, Marubeni, Mercuria, Mitsubishi, Mitsui, Petrobras, PetroChina, Petronas, Phillips 66, RWE, Saudi Aramco, SUMITOMO, Trafigura, Valero Energy, Vitol, World Fuel Services.

5.2 Relevant regulatory agencies

Office of Gas and Electricity Markets

The Office of Gas and Electricity Markets (Ofgem) is a regulator with the responsibility for protecting the interests of electricity and gas consumers, security of supply, sustainability, supervision and development of markets and competition.

Companies House

The Companies House is the United Kingdom’s register of companies and is empowered to incorporate and dissolve limited companies, examine and store company information, and make information available to the public.

HM Revenue and Customs

HM Revenue and Customs (HMRC) is the United Kingdom’s tax, payments and customs authority. HMRC’s responsibilities include the facilitation of legitimate international trade, protection of the UK’s fiscal and economic security before and at the border, and collection of UK trade statistics.

The Serious Fraud Office

The Serious Fraud Office (SFO) is a specialist prosecuting authority tackling the top level of serious or complex fraud, bribery and corruption. The SFO is empowered to investigate and prosecute criminal cases under the Bribery Act 2010, and in addition, the SFO aims to recover the proceeds of crime so that fraudsters do not benefit from their offending and victims can be compensated wherever possible.

5.3 Regulatory framework

5.3.1 Specific regulations applicable to commodity trading transactions

The Gas Act 1986

Under the Gas Act 1986, Ofgem is empowered to grant gas shippers licenses to any company to arrange with a gas transporter for gas to be introduced into, conveyed through, or taken out of a pipeline system operated by that gas transporter within the United Kingdom. It is possible that some “first trade” purchases of publicly-owned oil, gas or minerals may be caught under these provisions – although this is not the purpose of these licences. Furthermore, holders of gas shippers’ licences are not obliged to routinely disclose information on the origins of gas shipments or payment terms to Ofgem.

Electricity and Gas (Market Integrity and Transparency) (Enforcement etc) Regulations 2013

The Electricity and Gas (Market Integrity and Transparency) (Enforcement etc) Regulations 2013 provide a mechanism for the continuation of the United Kingdom’s role in REMIT following the United Kingdom’s departure from the European Union. REMIT refers to the Regulation (EU) No. 1227/2011, Regulation on Wholesale Energy Market Integrity and Transparency which was adopted at EU level in order to increase the transparency and stability of the European energy markets while combating insider trading and market manipulation, and creating a level-playing field for all market participants.

The provisions of REMIT apply to all market participants, which include energy trading companies, producers of electricity or natural gas (including producers supplying production to their in-house trading unit or energy trading company), shippers and transmission systems operators, and other entities.

The ECA Regulations empower Ofgem to require those are regulated under REMIT to provide information in connection with monitoring the integrity and transparency of the wholesale energy market.

Regulation (EU) 2017/821

On 17 May 2017 the EU adopted regulations laying down supply chain due diligence obligations for EU importers of tin, tantalum and tungsten, their ores, and gold originating from conflict-affected and high-risk areas based on the OECD’s Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas.

The UK left the EU on 31 January 2020 but EU law remained applicable in the UK during the transition period – up until 31 December 2020. While Regulation (EU) 2017/821 was enacted in 2017, its key operative provisions only came into force on January 1, 2021. Consequently, the applicability of the key conflict minerals provisions do not apply to companies operating in the UK.

5.3.2 General corporate law – reporting and transparency obligations applicable to commodity trading transactions

Companies Act 2006

Under the Companies Act 1996, all UK companies are required to prepare and submit a wide range of information to Companies House (including financial statements, details of officers and persons with significant control, etc.) on a regular basis.

Generally, accounts must include:

- a profit and loss account (or income and expenditure account if the company is not trading for profit);

- a balance sheet signed by a director on behalf of the board and the printed name of that director;

notes to the accounts;

- group accounts (if appropriate).

And accounts must generally be accompanied by:

- a directors’ report signed by a secretary or director and their printed name, including a business review (or strategic report) if the company does not qualify as small;

- an auditors’ report (unless the company is exempt from audit) - this must state the name of the auditor, and be signed and dated by them.

This information, with limited exceptions, is then made publicly available via the Companies House website.

There are no specific requirements in the Companies Act for companies to disclose information about purchases of publicly-owned oil, gas or minerals.

5.3.3 Anti-corruption requirements applicable to commodity trading transactions

Bribery Act 2010

The Bribery Act 2010 was enacted by the UK Parliament in order to better address the requirements of the OECD Anti-Bribery Convention. The Bribery Act has near universal jurisdiction and allows for the prosecution of an individual or a company with a link to the UK regardless of where their actions took place.

The Bribery Act criminalises the bribery of a foreign public official. Section 6(1) of the 2010 Act states: “[A] person (‘P’) who bribes a foreign public official (‘F’) is guilty of an offence if P’s intention is to influence F in F’s capacity as a foreign public official”.

The Bribery Act includes a strict liability offence of the failure of commercial organisations to prevent bribery on their behalf. The scope of this provision is broad – a company could be found guilty of this offence if the bribery is conducted by an employee, an agent, a subsidiary or a third party.

Proceeds of Crime Act 2002

The Proceeds of Crime Act 2002 provides for the confiscation or civil recovery of the proceeds from crime – including bribery under the Bribery Act 2010.

6. UNITED STATES

6.1 Overview of trading hub

In 2019, the United States was the largest economy in the world in terms of GDP, the second largest economy in terms of total exports and the largest economy in terms of total imports (Observatory of Economic Complexity (OEC), an analytical tool for understanding the dynamics of economic development).

The study by the Swiss Federal Government from March 2013 indicates that New York is home to a share of 25% of the global crude oil market. The United States is home to large commodities exchanges specialised in energy trading, such as the New York Mercantile Exchange (NYMEX) and the Chicago Board of Trade (CBOT). In addition, Houston plays a specific role as a hub for oil trading.

Major companies involved in commodity trading headquartered in the USA include: Archer Daniels Midland, Cargill, Castleton Commodities, Chevron, Conoco Phillips, ExxonMobil, Koch Supply and Trading, Marathon Petroleum, Phillips 66, United States Steel Corporation, Valero Energy, World Fuel Services.

Major companies with a trading desk or other significant presence include: AngloGold Ashanti, ArcelorMittal, BHP, BP plc, Centrica, EDF, Enel, Engie, ENI, Equinor, Gazprom, Glencore, Gunvor, Iberdrola, Louis Dreyfus, Lukoil, Mabanaft, Marubeni, Mercuria, Mitsubishi, Mitsui, PEMEX, Petrobras, PetroChina, Petroineos, REPSOL, Rio Tinto, RWE, Royal Dutch Shell, SUMITOMO, Total, Trafigura, Vitol.

6.2 Relevant regulatory agencies

Securities and Exchange Commission

The Securities and Exchange Commission (SEC) is a federal government agency with a mandate to promote capital markets that inspire public confidence and provide a diverse array of financial opportunities to retail and institutional investors, entrepreneurs, public companies and other market participants. The SEC enforces the statutory requirement that public companies and other regulated companies submit quarterly and annual reports, as well as other periodic reports.

United States Department of Justice

The United States Department of Justice (DOJ) is the agency responsible forleading the international fight against corruption by increasing the number of investigations, settlements, and prosecutions for violations of the Foreign Corrupt Practices Act.

6.3 Regulatory framework

6.3.1 Specific regulations applicable to commodity trading transactions

Dodd-Frank Wall Street Reform and Consumer Protection Act

Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) requires the annual disclosure of whether any conflict minerals (tantalum, tin, gold or tungsten) that are necessary to the functionality or production of a product of the company originated in the Democratic Republic of the Congo or an adjoining country.

An annual disclosure is required if:

- the company files reports with the SEC under the Exchange Act;

- the minerals are “necessary to the functionality or production” of a product manufactured or contracted to be manufactured by the company.

If so, the company must provide a report to the SEC describing, among other matters, the measures taken to exercise due diligence on the source and chain of custody of those minerals, which must include an independent private sector audit of the report that is certified by the person filing the report.

All of the information required to be published under these rules must be filed electronically with the SEC and immediately becomes publicly available upon filing. In addition the companies are required to:

- Make publicly available on its Internet website the description of the “country of origin inquiry” or the Conflict Minerals Report;

- Provide the Internet address of that site on Form SD.

Consequently, it is possible that some “first trade” purchases of publicly-owned minerals (tantalum, tin, gold or tungsten) from the Democratic Republic of the Congo or an adjoining country may be caught under the reporting requirements of Section 1502 – although this is not the express purpose of this legislation.

6.3.2 General corporate law – reporting and transparency obligations applicable to commodity trading transactions

Securities Exchange Act of 1934

Under section 13(a) of the Securities Exchange Act of 1934 (Exchange Act), companies with registered publicly held securities and of a certain size (see below) are Exchange Act "reporting companies," meaning that they must disclose continuously by filing annual reports (10Ks), quarterly reports (10Qs), and reports when certain events occur (8Ks), in accordance with SEC rules.

These periodic reports include or incorporate by reference types of information that would help investors decide whether a company's security is a good investment. Information in these reports includes information about the company's officers and directors, the company's line of business, audited financial statements, the management discussion and analysis section, and audited financial statements.

Companies that have not issued securities may still be required to file a registration statement under Section 12 of the Exchange Act if:

- The company has more than $10 million in total assets and a class of equity securities, like common stock, that is held of record by either (1) 2,000 or more persons or (2) 500 or more persons who are not accredited investors; or

- it lists the securities on a U.S. exchange.

There are no specific requirements in the Securities Exchange Act of 1934 for companies to disclose information about purchases of publicly-owned oil, gas or minerals

6.3.3 Anti-corruption requirements applicable to commodity trading transactions

Foreign Corrupt Practices Act 1977

Foreign bribery is criminalised under the Foreign Corrupt Practices Act 1977 (FCPA). The FCPA is applicable worldwide and extends specifically to publicly traded companies and their personnel, including officers, directors, employees, shareholders, and agents, as well as foreign firms and persons who, either directly or through intermediaries, help facilitate or carry out corrupt payments in U.S. territory.

The anti-bribery terms of the FCPA apply to corrupt payments made to foreign officials, which include officers or employees of a department, agency, or instrumentality of a foreign government. A person or company is guilty of violating the law if the DOJ can prove the existence of:

- a payment, offer, authorization, or promise to pay money or anything of value

to a foreign government official (including a party official or manager of a state-owned concern), or to any other person, knowing that the payment or promise will be passed on to a foreign official

- with a corrupt motive

- for the purpose of (a) influencing any act or decision of that person, (b) inducing such person to do or omit any - action in violation of his lawful duty, (c) securing an improper advantage, or (d) inducing such person to use his influence to affect an official act or decision

- in order to assist in obtaining or retaining business for or with, or directing any business to, any person

The FCPA also requires companies whose securities are listed in the United States to meet its accounting provisions. These provisions were designed to operate in tandem with the anti-bribery provisions of the FCPA, and require companies to (a) make and keep books and records that accurately and fairly reflect the transactions of the corporation and (b) devise and maintain an adequate system of internal accounting controls.

Disclaimer

In this Stocktake, the OECD has set out the reporting and transparency requirements that apply to companies purchasing publicly-owned oil, gas and minerals, as well as general anti-corruption provisions applicable in those trading hubs. The OECD acknowledges that companies entering into commodity trading transactions in those hubs would be subject to a wide array of regulatory additional requirements (for example, AML-CFT, customs and excise, environmental, human rights and taxation). However, those additional regulatory requirements are outside the scope of this Stocktake.

The companies involved in commodity trading covered in this Stocktake represent a sample of global commodity trading industry. Given the sheer number of commodity trading companies worldwide, and the difficulties in identifying and categorising each one, this Stocktake has focused on some of the larger and more prominent companies to demonstrate the presence of commodity trading across multiple hubs.

Find out more

Policy Dialogue on Natural Resource-based Development (PD-NR)

Related Documents