Regional development

Making the Most of Public Investment in a Tight Fiscal Environment

Key messages | Executive summary | Table of contents

Downloads | Related reading | Buy this book | Contact

ISBN Number: Pages: 198 Publication date: |

How to make the most of public investment? This question is critical in today’s tight fiscal environment. Given that sub-national governments in OECD countries carry out more than two-thirds of total capital investment, they have a crucial role to play in this area. Better multi-level governance of public investment has become a priority and a pre-condition for making better use of scarcer fiscal resources. In order to identify good practices for governance of public investment across levels of government, the report focuses on lessons that can be extracted from the management of stimulus packages that were implemented in 2008-09. Indeed, these strategies were largely based on public investment in some countries, and sub-national governments played a key role in executing them. This report provides an overview of challenges met in the implementation of investment recovery strategies across levels of government and highlights good practices and lessons learned, focusing on eight country cases: Australia, Canada, France, Germany, Korea, Spain, Sweden and the United States |

This report provides an overview of challenges met in the implementation of investment recovery strategies across levels of government and highlights good practices and lessons learned, focusing on eight country cases: Australia, Canada, France, Germany, Korea, Spain, Sweden and the United States. These countries all targeted similar objectives – to implement recovery schemes in a timely, targeted and temporary manner – and addressed common implementation challenges, although their institutional frameworks vary greatly.

The report shows that the effectiveness of recovery strategies based on public investment depends largely on the arrangements between levels of government to design and implement the investment mix. As stimulus packages are phased out, and countries pursue fiscal consolidation, there is a risk that long-term public investment, a basis for future economic growth, will be sacrificed to short-term budgetary pressures. Co-ordination between levels of government was essential to implement recovery measures during the crisis; it is at least as important in the context of fiscal consolidation, as governments struggle to make the most of limited investment resources for sustainable growth.

| Key messages |

- A key role for sub-national governments in the recovery from the crisis.

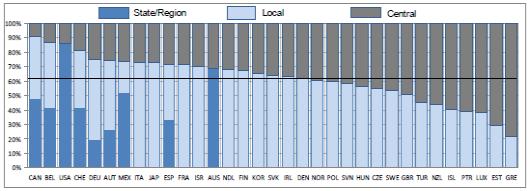

During the 2008 crisis and subsequent recession, many OECD and G20 countries implemented stimulus packages, which in some cases amounted to 4% or more of GDP (Australia, Canada, Korea, United States). On the expenditure side, the fiscal programmes typically focused on public investment. Given their large traditional role in public investment in OECD countries, sub-national governments (SNGs) have played an important role in implementing investment recovery strategies as part of national stimulus packages recovery measures. SNGs are responsible on average for 66% of OECD investment spending (see Figure 1 below). Some countries specifically targeted their fiscal recovery packages towards sustaining public investment for SNGs. For example, one-quarter of investment funds have been administered by Länder in Germany, one-third of the stimulus package has been managed by states in the United States, half of the investment funding in Australia has been implemented by sub-national actors, and around 75% in Korea and Spain.

Figure 1. Share of each level of government in total public investment

(measured as Gross Fixed Capital Formation), 2010

Source: OECD National Accounts (2010).

- Speed has mainly determined the selection of investment projects. Investment strategies launched during the recession had a difficult path to take: they had to be implemented quickly, correspond to strategic priorities and be transparent and subject to rigorous scrutiny. These dimensions are difficult to reconcile. Investment strategies have sought in priority “shovel-ready” infrastructure projects, i.e. projects well advanced in planning and ready to be launched. By the end of 2010, most countries had already allocated more than 90% of the funds, in part through local governments (Australia, Canada, Germany, France, Korea, Spain, United States). Actual spending has been slower, however, and there have been significant variations across policy areas. Requirements for the use of funding have had a strong influence on the type of projects selected by sub-national governments. Micro-scale short-term infrastructure projects conducted at the municipal level could easily meet the criteria for eligibility. The emphasis on speed in committing funds, although understandable as a goal, has probably overshadowed planning for maximum economic impact.

- The crisis crystallised multi-level governance challenges. The crisis has brought to the fore multi-level governance challenges that are inherent to decentralised political systems, including: i) the fiscal challenge, or the difficulty of co-financing investment; ii) the capacity challenge, linked to inadequate resources, staffing or processes for rapid, efficient and transparent implementation of investment funding; iii) the policy challenge, or the difficulty of exploiting synergies across different sectors and policy fields; and iv) the administrative challenge, or the fragmentation of investment projects at the local level. These different types of challenges affect the implementation of investment schemes differently depending on regional circumstances, and can lead to unintended consequences, ultimately potentially undermining the impact of the plans.

- Appropriate co-ordination across levels of government has proven critical for facilitating the implementation process, targeting investment priorities and ensuring coherence in policy objectives. Arrangements between levels of government to design and implement the investment mix are critical in particular to bridge the policy and financial gaps across levels of government, enhance complementarities across programmes, facilitate public-private co-operation and foster transparency in the use of funding at all levels. For example, the responsiveness of the Australian government during the crisis was helped by the presence of a well-developed multi-level governance body, the Council of Australian Governments (COAG), which provided a forum for decision making and prioritisation of investment. In Sweden, “regional co-ordinators” were created to co-ordinate policies and resources from different levels of government. Horizontal co-ordination across jurisdictions has also been essential to target effectively the relevant scale for investment. In Germany for example, implementation of the sub-national investment package was entirely decentralised and there were some good practices of inter-municipal co-operation, for example in Nordrhein-Westfalen where an agreement was reached across municipalities for the allocation of funds.

Making the most of public investment in times of fiscal consolidation

In a short span of time (2008-11), most OECD member countries have rapidly switched from highly expansive fiscal policies to the tightest ones in decades. The crisis has left a strong and lasting imprint on OECD member countries’ public finances. Nearly half of OECD countries plan to scale back public investments in their consolidation plans. Local public investment, after being stimulated in 2008-09, is now a target of cuts in many regions and the main adjustment variable of the sub-national budget. Yet public investment, if well managed, represents a potentially important growth-enhancing form of public expenditure. Confronted with the challenge of supporting growth in such a tight fiscal environment, then, national and sub-national governments face the imperative of “doing better with less” when it comes to investment. Better governance has become a priority and a pre-condition for making better use of scarcer fiscal resources. Sub-national governments have a critical role to play here.

- Multi-level governance challenges may in fact be amplified in the current context if appropriate co-ordination measures are not mobilised and if the focus is only on the short-term.

Policy co-ordination, transparency and information sharing across levels of government are equally crucial during the consolidation as during the management of the stimulus. It is all the more important to enforce strategies since budget cuts are by nature more difficult to implement than budget increases. Risks include a cascading effect, where each level of government transmits the reduction in their budgets to lower levels of government. To avoid simply shifting the problem from the centre to the regions, co-ordinated efforts from all levels of government are required to accommodate appropriate budget cuts for fiscal consolidation and better prioritise investment in what unlocks each region’s potential to restore growth.

- Given these challenges, multi-level governance instruments are among the few remaining tools to implement growth policies effectively. In particular, this requires achieving more complementarity between different types of investments (e.g. infrastructure, innovation and human capital). An approach to public investment, which takes little account of regional specificities or information emanating from regional actors, is unlikely to be successful.

- Drawing on the experience of the crisis, it is possible to identify a common set of guidelines for multi-level governance of public investment. These good practices include combining investments in physical infrastructure with the provision of soft infrastructure (e.g. skills development); improving the co-ordination and implementation of investment strategies across levels of government, using policy incentives in transfer agreements or partnerships between levels of government to achieve common objectives; enhancing horizontal coordination within functional regions; building transparent management processes; bridging information gaps across public actors; and enhancing data and performance indicator availability through robust risk management.

|

Executive summary |

Read the Executive summary or download it for free.

Read the Executive summary or download it for free.

| Table of contents |

Executive Summary

Part I Comparative overview: challenges and lessons

Introduction

1. A critical role for sub-national governments during the recovery

2. Managing investment across levels of government: key challenges

3. Overcoming obstacles to implementation: the need for co-ordination

4. Making the most of public investment in times of austerity

Part II Country CasesChapter 1. Australia

Chapter 2. Canada

Chapter 3. France

Chapter 4. Germany

Chapter 5. Korea

Chapter 6. Spain

Chapter 7. Sweden

Chapter 8. United States

| Related OECD documents for download |

| Related reading |

- Fiscal Federalism Network

- Government at a Glance 2011

- OECD Regions at a Glance 2011

- Restoring Public Finances - New report outlining the fiscal consolidation plans of 30 OECD countries

- Water and Multi-Level Governance

- OECD work on Multi-level Governance

| How to buy this book |

Readers can access the full version of Making the Most of Public Investment in a Tight Fiscal Environment: Lessons from the crisis by choosing from the following options:

-

Subscribers and readers at subscribing institutions can access the online edition via OECD iLibrary, our online library.

-

Non-subscribers can browse the full text on line and purchase the PDF e-book and/or paper copy via our Online Bookshop.

-

Order from your local distributor.

-

Government officials with accounts (subscribe) can go to the "Books" tab on OLIS.

| Contact |

For more information, please contact Dorothée Allain-Dupré: Dorothee.Allain-Dupre@oecd.org.

Related Documents