Fiscalité

OECD releases latest results on preferential regimes and moves to strengthen the level playing field with zero tax jurisdictions

15/11/2018 - International efforts to curb harmful tax practices and prevent the misuse of preferential tax regimes are having a tangible impact worldwide, according to new data released today by the OECD.

The latest progress report from the Inclusive Framework on BEPS covers the assessment of 53 preferential tax regimes, demonstrating jurisdictions' continuing resolve to ensure that tax breaks are only offered to substantive activities and only if they do not pose risks of harmful competition to others.

The assessment process is part of ongoing implementation of Action 5 under the OECD/G20 Base Erosion and Profit Shifting Project. The assessments are undertaken by the Forum on Harmful Tax Practices (FHTP), comprising of the more than 120 member jurisdictions of the Inclusive Framework. Action 5 revamps the work on harmful tax practices with a focus on improving transparency, including compulsory spontaneous exchange on rulings related to preferential regimes, and on requiring substantial activity for preferential regimes, such as IP regimes. The latest batch of assessments includes:

- 18 regimes where jurisdictions have delivered on their commitment to make legislative changes to abolish or amend the regime (Andorra, Curaçao, Hong Kong (China), Mauritius, San Marino and Spain).

- Four new or replacement regimes that have been specifically designed to meet Action 5 standard (Lithuania, Mauritius and San Marino).

- New commitments to make legislative changes to amend or abolish a further 10 regimes, by Aruba, Australia, Maldives, Mongolia, Montserrat, the Philippines and Saint Lucia.

- An additional 17 regimes that have been brought into the FHTP review process (Aruba, Brunei Darussalam, Curaçao, Gabon, Greece, Jordan, Kazakhstan, Malaysia, Panama, Paraguay, Saint Kitts and Nevis and the United States).

- Four other regimes that have been found to be out of scope, not yet operational or were already abolished or without harmful features (Aruba, Kenya, Paraguay).

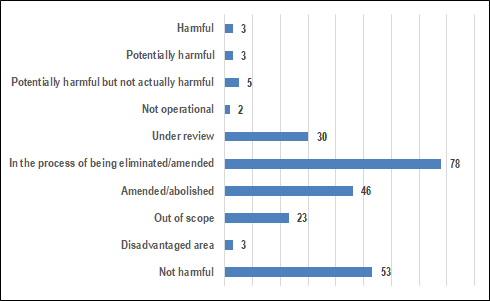

Having completed this latest set of reviews, the cumulative picture of the Action 5 regime review process is as follows, bringing the total number of regimes reviewed to 246:

These results indicate the extent of continuing work to end harmful tax practices, and ensures that in the future all preferential regimes require real substance.

Given that all preferential regimes for geographically mobile income must now meet the Substantial Activities Requirements, it is essential to ensure that business activity does not simply relocate to a zero tax jurisdiction in order to avoid the substance requirements. This would tilt the playing field for those that have now changed their preferential regimes to comply with the standard and jeopardise the progress made in Action 5 to date. Against this backdrop, the Inclusive framework has decided to apply the Substantial Activities Requirement for "no or only nominal tax" jurisdictions.

"This new global standard means that mobile business income can no longer be parked in a zero tax jurisdiction without the core business functions having been undertaken by the same business entity, or in the same location," said Pascal Saint Amans, director of the OECD Centre for Tax Policy and Administration. "The Inclusive Framework's actions will ensure that substantial activities must be performed in respect of the same types of mobile business activities, regardless of whether they take place in a preferential regime or in a no or only nominal tax jurisdiction."

The FHTP will next meet in January 2019, to assess continuing reviews on the remaining regimes for which commitments to amend or abolish were made in 2017. Further discussion on all other regimes will take place through the FHTP review process in 2019. The FHTP will also work on the next steps for assessing compliance with the global standard for no or only nominal tax jurisdictions, and continue to report results to the Inclusive Framework.

For more information on the BEPS Action 5 peer review and monitoring process, visit: www.oecd.org/tax/beps/beps-action-5-peer-review-and-monitoring.htm

Media queries should be directed to Pascal Saint-Amans, Director of the OECD Centre for Tax Policy and Administration (+33 1 45 24 91 08), or Achim Pross, Head of the International Co-operation and Tax Administration Division (+33 6 21 63 27 67).

Documents connexes