Productivity and long term growth

Going for Growth 2018 - Italy note

Going for Growth is the OECD flagship report analysing structural policy settings and economic performance to provide policymakers with concrete reform recommendations to boost growth and ensure that the gains are shared by all. The 2018 Interim Report reviews the main growth challenges and takes stock of reforms enacted over the past year - in both advanced and emerging economies - on policy priorities identified in the previous issue of Going for Growth.

Country highlights

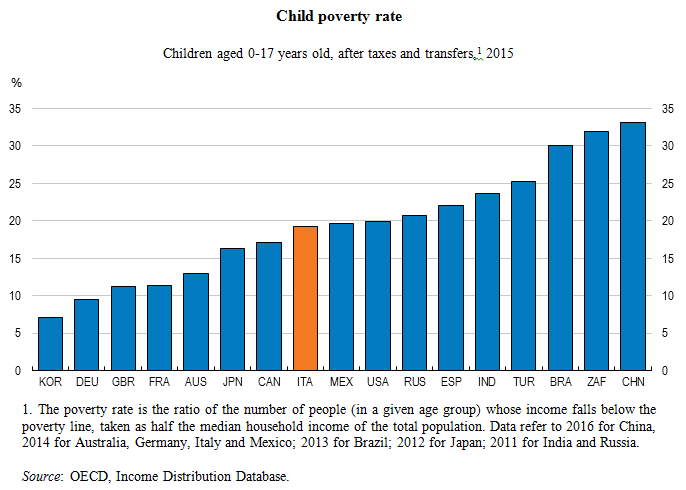

Structural reforms are starting to pay-off but despite some improvements in recent years, economic growth remains weak and the unemployment rate is high, especially among youth and long-term unemployed. Challenges remain in terms of productivity and investment, jobs and skills, but also child poverty, which has a negative influence on adult lives. Over the last ten years, poverty has increased especially among youth, reflecting the ineffectiveness of local anti-poverty programmes. More investment in infrastructures will improve productivity and thus limit the negative gap in GDP per capita vis-à-vis the most advanced OECD countries. Progress on reforms also depends on the capacity to restore trust through improving the efficiency of public administration and fighting corruption.

Going for Growth 2017 recommendations include:

- Improve the efficiency of public administration by implementing a performance-based human resource system and improving skills. Reinforce the rule of law by fighting corruption, streamlining the court system and extending the e-tax process.

- Promote higher and better quality investment by implementing the new public procurement code for construction works, improving the selection of infrastructure projects and fighting corruption. Foster private investment exploiting EU initiatives and deepen Trans-European networks and the Energy Union. Revive bank credit to firms and private investment by supporting policies undertaken to work out banks’ non-performing loans. Continue to streamline insolvency procedures to accelerate the restructuring of viable firms and the exit of those which are no longer viable. Implement and evaluate recent programmes to bolster links between research universities and the private sector. Raise the share of funds allocated to public research by strengthening the monitoring and evaluation of public research.

- Enhance active labour market policies to limit the duration of unemployment and avoid social exclusion by implementing a process to assess activation measures and job centres. Establish partnerships between private job agencies and the National Agency for Active Labour Policies (ANPAL) to increase job offers and improve the quality of training services.

- Reduce job-skill mismatch by encouraging universities and technical schools to revise their curricula to match actual and future labour market needs while making firm-level wage setting mechanisms more flexible. Motivate labour mobility by shifting housing taxation from transactions to ownership.

- Improve the efficiency of the tax structure and strengthen the social safety net by maintaining efforts against tax evasion, lowering high nominal tax rates and abolishing tax expenditures. Lower social security contributions for low-wage workers. Shift taxation towards immovable property using revised cadastral values and shift the tax burden to environmental taxes. Improve targeting of anti-poverty programmes and limit their fragmentation.

Recent policy actions in these areas include:

- An anti-poverty nationwide programme, the ‘Inclusive Income’ scheme, has been set up to curb poverty and enhance social cohesion, especially among families with children. The targeting of social benefits has been improved.

- The public procurement code has been modified to improve the effectiveness of infrastructure spending and make the selection of infrastructure projects based on objective criteria.

- Measures against tax evasion, in particular Value Added Tax, and to encourage voluntary tax compliance have been enacted to raise additional revenues.

Italy: Latest Economic Forecast

Related Documents