Productivity and long term growth

Going for Growth 2018 - Spain note

Going for Growth is the OECD flagship report analysing structural policy settings and economic performance to provide policymakers with concrete reform recommendations to boost growth and ensure that the gains are shared by all. The 2018 Interim Report reviews the main growth challenges and takes stock of reforms enacted over the past year -- in both advanced and emerging economies -- on policy priorities identified in the previous issue of Going for Growth.

Country highlights

The gap in GDP per capita relative to the most advanced OECD countries remains large with sluggish productivity growth, which has only recently started to show signs of recovery. Inequality remains above the OECD average, partly driven by the fall in the share of income going to the poorest sections of the population and consecutive years of wage moderation.

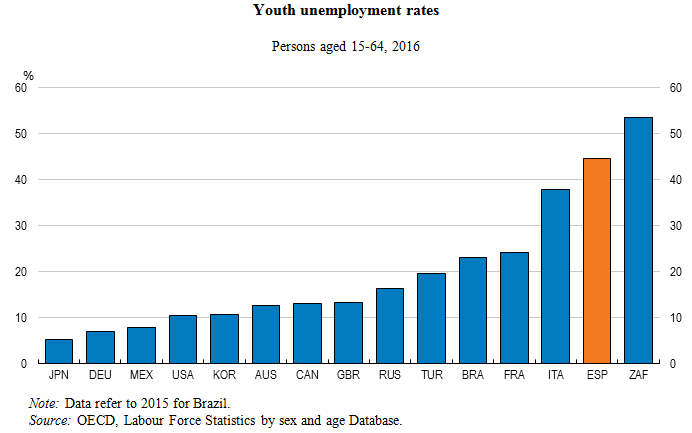

Improving access to vocational and higher education as well as the labour market content of programmes would boost skills and productivity while also contributing to close the large gap in youth unemployment. Further reducing barriers in service sectors would also bring employment and productivity gains. Reforming taxation by phasing out exemptions, improving VAT administration and making more use of environmental taxes would improve further the growth friendliness and efficiency of the tax system.

Going for Growth 2017 recommendations include:

- Improve the efficiency and progressivity of the tax system by further reducing the labour tax wedge on low-wage workers on both permanent and temporary contracts. Broaden the tax base by phasing out exemptions to the income, corporate, VAT and environmental taxes. Improve VAT administration and enforcement. Increase environmental taxes, including taxes on road transport fuel and the per-litre tax on diesel to at least the level of the tax on gasoline.

- Improve access to vocational and higher education and ensure that associated programmes adapt to labour market needs by improving the quality of teaching through adequate university training for teachers and on-the-job training. Continue the development and modernisation of vocational education and training (VET), expand dual VET and ensure greater role of employers in designing curricula and training students. Increase university specialisation. Do not reduce average university grants until other financing alternatives, such as loans with income-contingent repayments, are available.

- Strengthen active labour market policies by continuing to boost resources and efforts to improve the efficiency of public employment services to enhance the delivery of activation policies. Make effective the reform of the training system for the unemployed, introduce systematic evaluation of training schemes and evaluate wage subsidies. Re-skill the long-term unemployed via the VET system and second-chance schools.

- Reduce labour market duality by pursuing greater convergence of termination costs between permanent contracts and temporary contracts.

- Lower entry barriers in non-manufacturing industries by reducing the number of professions requiring membership in a professional body and the cost of membership. Reduce regulatory barriers to entry in rail and maritime transport. Speed up the sectorial adaptation of the Market Unity Law and its full implementation to all economic activities.

Recent policy actions in these areas include:

- Active labour market policies have been stepped up with an increase in spending as well as the expansion of specific programmes. The coordination among administrations has also been improved.

- The efficiency of the tax system has been improved by the recent broadening of the corporate income tax base. Taxes on alcohol and tobacco have also been increased. An electronic VAT filing system to address VAT fraud has been legislated.

Spain: Latest Economic Forecast

Related Documents