Productivity and long term growth

Going for Growth 2018 - Australia note

Download full G20 media kit for Australia

Going for Growth is the OECD flagship report analysing structural policy settings and economic performance to provide policymakers with concrete reform recommendations to boost growth and ensure that the gains are shared by all. The 2018 Interim Report reviews the main growth challenges and takes stock of reforms enacted over the past year -- in both advanced and emerging economies -- on policy priorities identified in the previous issue of Going for Growth.

Country highlights

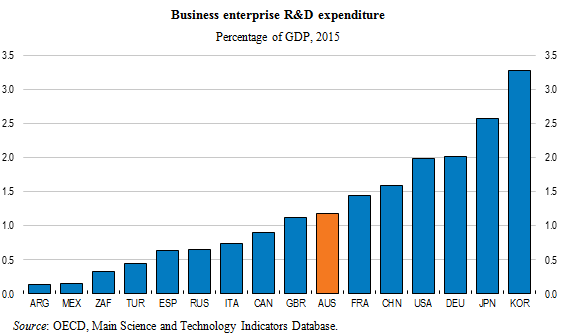

GDP per capita is around the average of the most advanced OECD countries but has slowed as the economy rebalances in the face of diminishing resource-sector investments and weak global commodity prices. Labour productivity growth has now picked up but reflects to a large extent investment in machine and equipment, less so investment in innovation and other intangible assets. Inequality remains above the OECD average, not least due to the low share of national disposable income held by the poorest.

Raising productive capacity should focus on continuing infrastructure improvement, encouraging innovation, facilitating the adoption of new technologies and boosting skills, which would also help in reducing inequality.

Going for Growth 2017 recommendations include:

- Improve framework conditions for businesses and strengthen competition by following-up the Harper review along with road construction and broadband upgrading, and by encouraging business dynamism in particular through streamlined insolvency regulation.

- Enhance the framework for innovation by pursuing the implementation of the National Innovation and Science Agenda. Alongside general framework conditions for business, there should be particular attention to improving university-business linkages, more effective R&D tax incentives, stronger commercialisation of public-sector research organisations and more co-ordinated governance of the innovation system.

- Improve performance and equity in education by pressing on with the multi-year schooling reform and working further towards childcare that target lower-income households and facilitate combining work and family life.

- Improve the efficiency of the tax system by developing a package of tax reforms that envisages raising the rate of goods and services tax and/or widening the base in combination with further cuts in direct taxation and the removal of inefficient taxes (for instance, many state-level fees and charges fall into this category).

- Improve opportunities and outcomes for indigenous communities by intensifying assessment of current measures and the options for alternative approaches, as part of a commitment to a more rapid narrowing of gaps in socio-economic opportunities and outcomes for indigenous communities.

Recent policy actions in these areas include:

- The Youth Jobs PaTH programme has been created to improve skills and opportunities of indigenous communities.

- Commitment to tax reforms centred on corporate-tax rate reduction was re-affirmed in the 2017-18 Federal Budget proposals. More imported goods and services, notably those purchased via internet platforms, will be now subject to Australia's VAT (the Goods-and-Services Tax) under legislation passed in 2017.

Australia: Latest Economic Forecast

Related Documents